FROM THE DESK OF ANDRÉS

Articles

Upcoming new Federal Reserve Chair and what it means

Hope you are having a great start to the week! From Capital Group: "President Trump picked former fed governor Kevin Warsh to lead the U.S. Federal Reserve (“The Fed”), elevating a recently dovish voice at a moment when policymakers are trying to decide how far and...

5 keys to investing in 2026

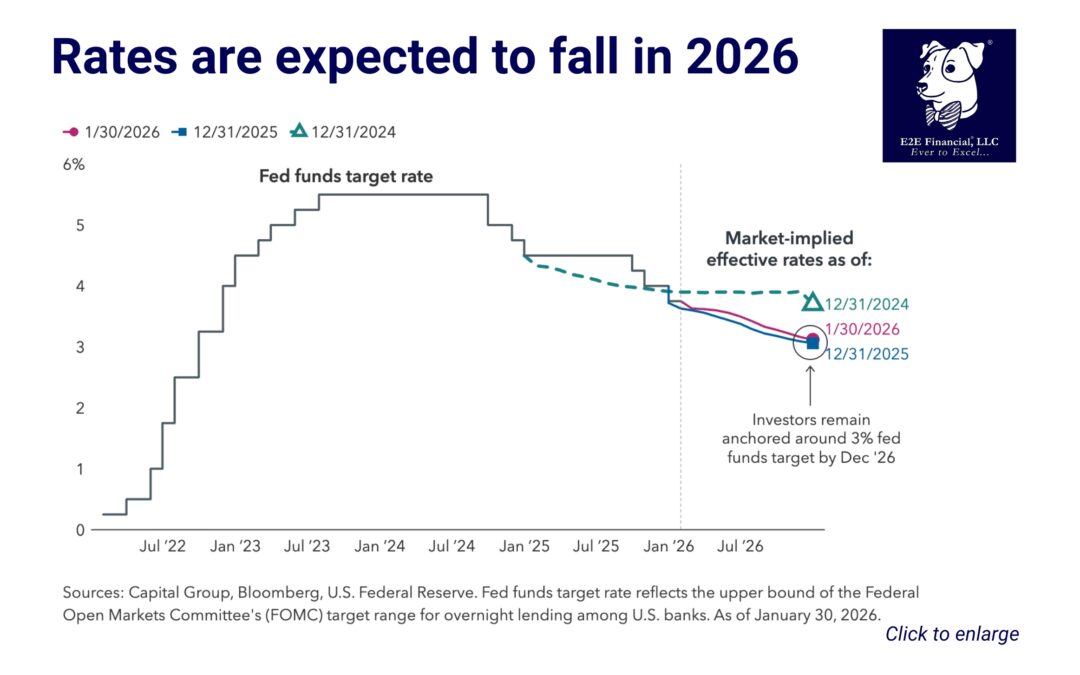

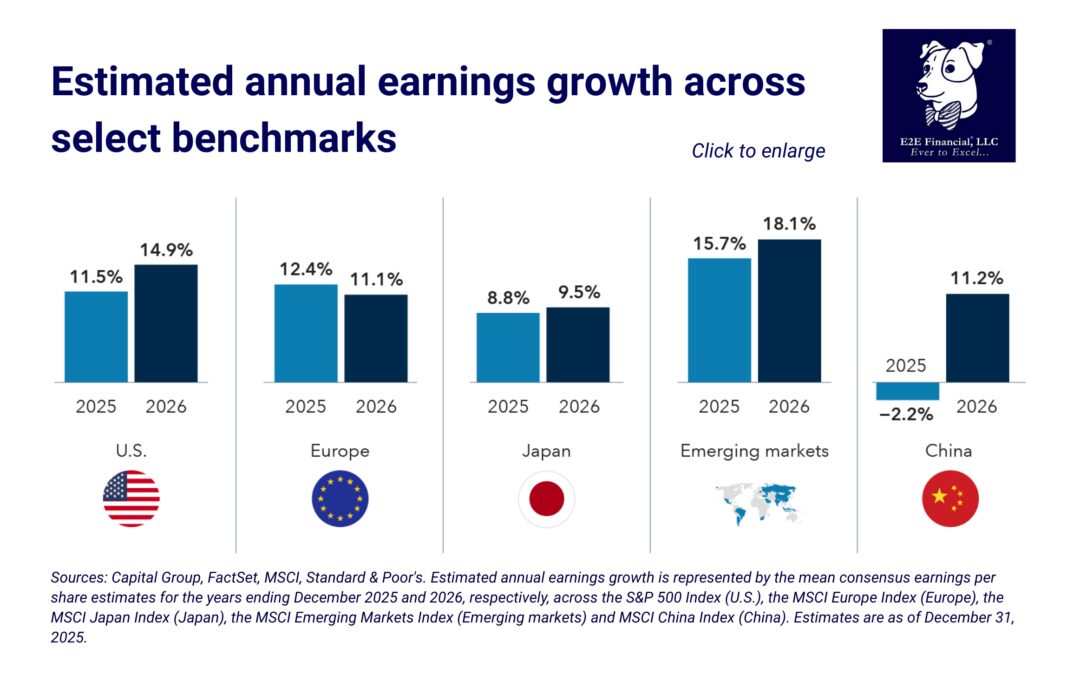

Hope you are having a great start to the week! Here is some insight from Capital Group: "After three straight years of double-digit returns for the S&P 500 Index, investors are entering 2026 with equal parts confidence and caution. Whether the rally will stretch...

Could U.S. GDP growth hit 5% this year?

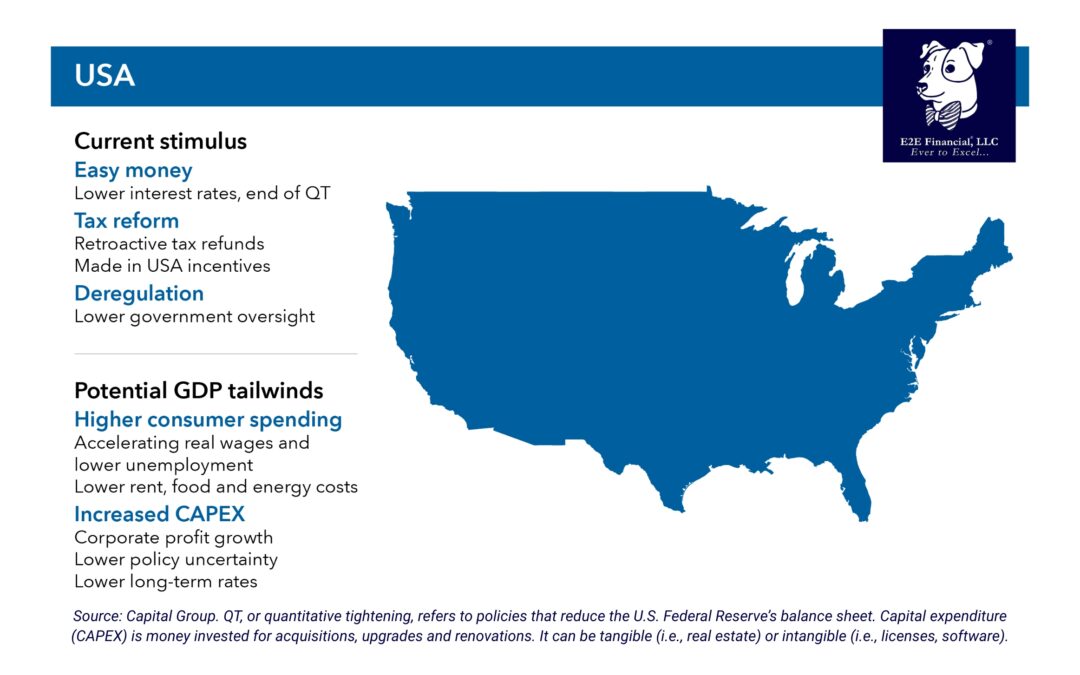

The resilience of the U.S. is amazing. Despite all the turmoil in the world, the U.S. economy somehow manages to look past it, power through it, and come out stronger on the other side. Here's what Capital Group economist Jared Franz has to say: "There is a lively...

How U.S. midterm elections may affect markets

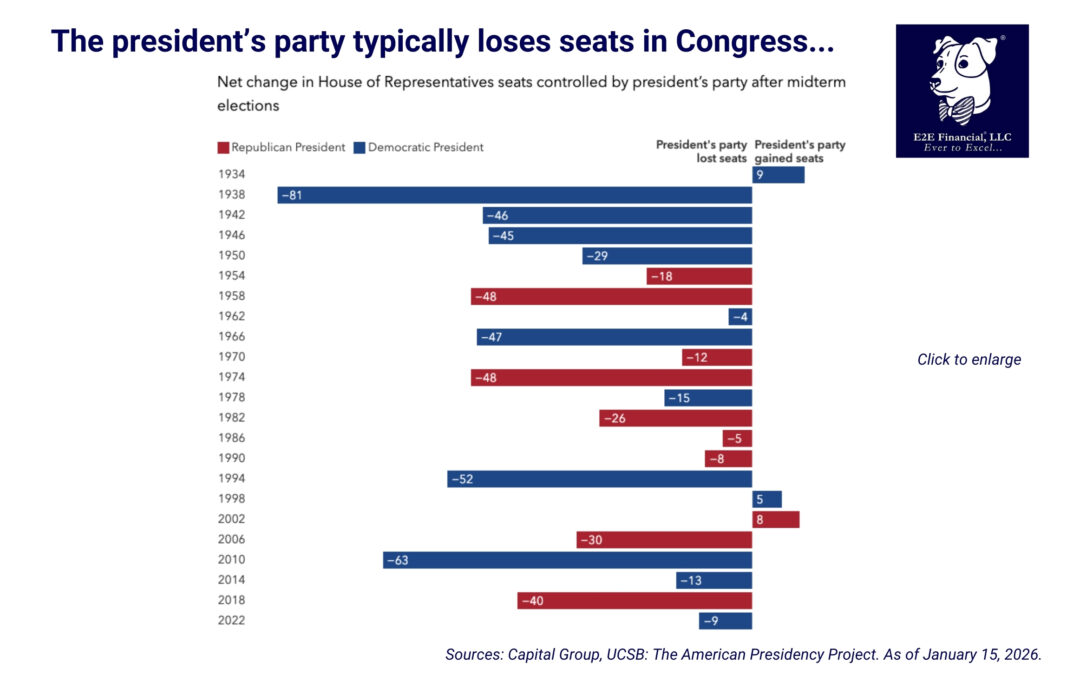

With everything happening in the world — from the U.S. push to annex Greenland, to new tariffs against Europe, to military intervention in Venezuela — investors may not be focused on the U.S. midterm elections just yet. But this pivotal contest is 10 months away, and...

Stock market outlook: 3 investment strategies for 2026

As we head into 2026, investors are asking some big questions: Has the AI boom gone too far? Are markets properly pricing in policy uncertainty? And can strength outside the U.S. continue to hold? Capital Group believes the market is entering a new phase, one defined...

Better Serving you in 2026

We’re excited to share an important milestone with you. Over the past several months, we’ve been working behind the scenes to ensure we can continue delivering the same high-level service you expect, while finding new ways to improve and grow. As part of that...

Start 2026 off Strong

We want you to have a great start to 2026! Here are 3 key financial steps to help make 2026 your most successful year yet: Review your 401(k) plan contributions. Are you maximizing your retirement nest egg? Review your tax withholdings. Are you in line to not pay...

Read This Before You Donate

The holiday season is in full swing and with that comes floods of donation requests. It's important to understand which ones actually spend their funds the way they advertise. To take the guesswork out of it websites like charitywatch.org and give.org are great ways...

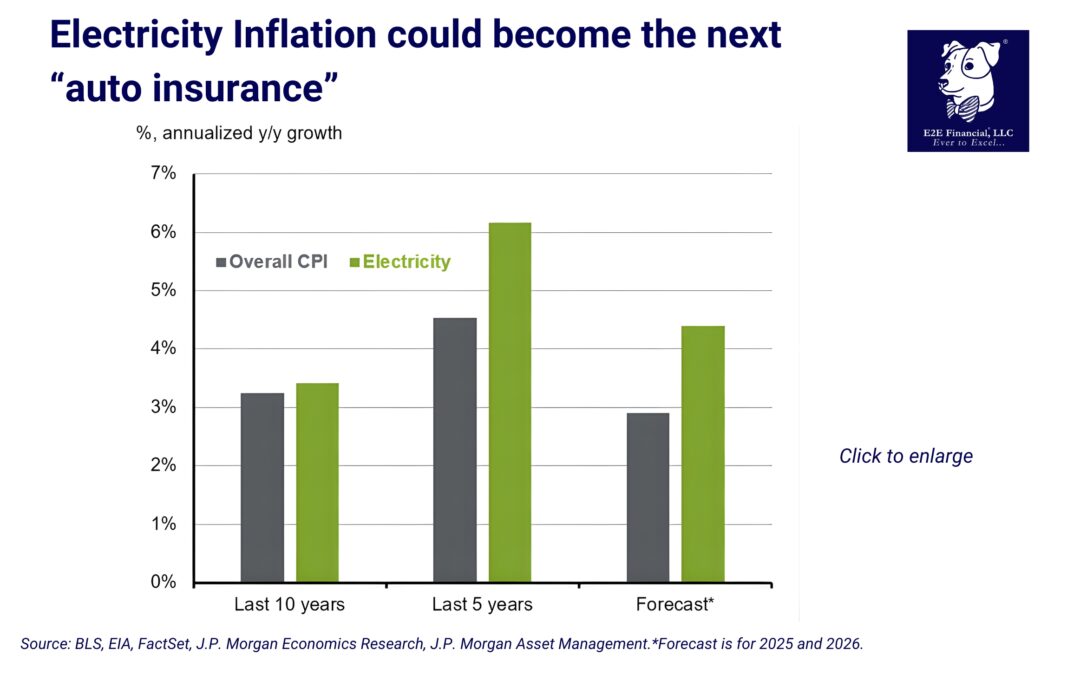

High Electric Bill this Month?

Have you noticed your electricity bill was extremely high this month? Well it's not JUST those holiday decorations contributing to that. According to recent insights from J.P. Morgan, AI data centers can be the one to blame for the sudden spike. Despite being a small...

Make 2026 your most successful year yet

As the year wraps up, now is a great time to look ahead. The steps you take today can help set you up for a stronger, more organized financial start in 2026. To make the process simple, we put together a quick checklist based on our 2026 Financial Success Tracker...

Tax Ideas

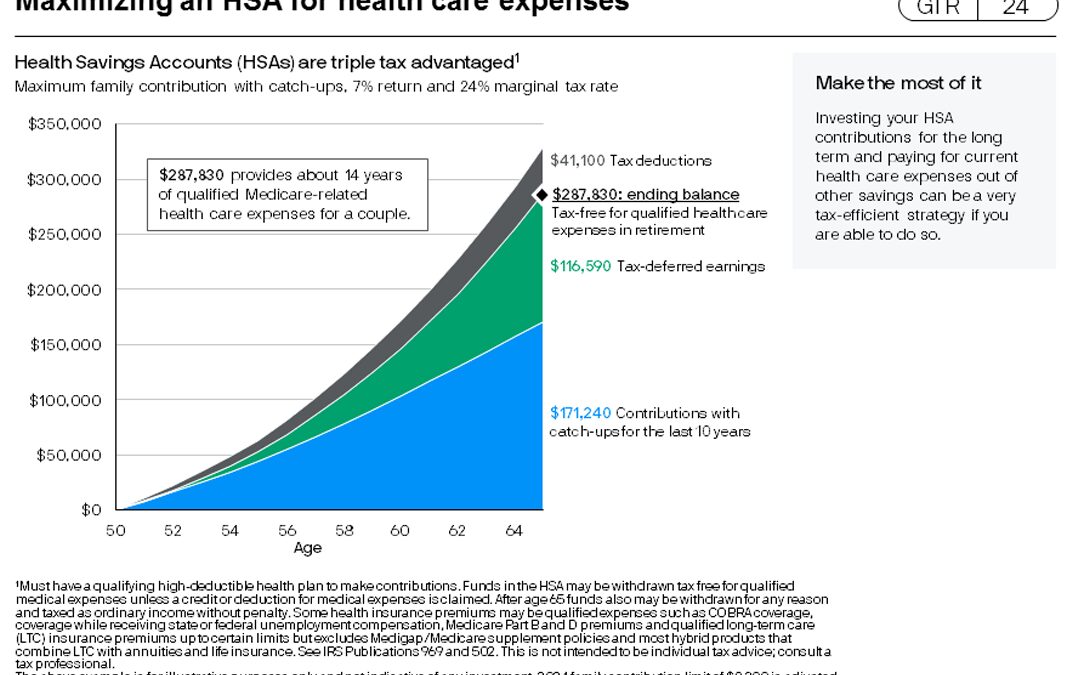

The GREATEST Tax Benefit Available! If You Qualify… 😉

A health savings account (HSA) may be the best tax-beneficial tool you can use. Health Savings Accounts are triple-tax free, so if eligible to contribute, make the most of it! Tax advantages include: Tax-free or tax-deductible contributions Tax-deferred earnings in...

Due to NEW Tax Legislation, Reviewing Your Beneficiaries has Become VITAL!

As we have mentioned before, the new tax legislation is making things harder for beneficiaries of retirement plans. First let’s review retirement account (RA) beneficiaries in general. All retirement accounts, like IRAs, 401k’s, pensions, etc., must have a named...

Tax Rates Set to Expire. Are YOU Ready?

Many of the Tax Cuts and Jobs Act (TCJA) of 2017 provisions which reduced income taxes for all of us are set to expire December 31, 2025 if congress does not vote to extend them. Given the poor job the US Congress does to take action and the historically high US debt:...

Charitable Contributions from IRAs

The Pension Protection Act of 2006 first allowed taxpayers age 70½ and older to make tax-free charitable donations directly from their IRAs.

Donor-Advised Fund

A donor-advised fund offers an easy way for a donor to make significant charitable gifts over a long period of time.

Videos

See You at the University of Alabama at Birmingham Vendor Fair!

See You at the Hinman!

Thank you, Hinman!

Dental Post Survey Review

Happy 2022!

Year End Planning

First Step Toward Success

3 Steps New Dentists Can Take

GA Dental Association Convention & Expo

Life in a Box

401k Plan Monitoring: Why and What to Do

E2E Financial and Capital Group – Investing During an Election Year

3 Key Questions to Ask About Your 401k

E2E Financial: Working with Dentists: 3 Key Points

E2E Financial: Partnering With Your CPA

E2E Financial What Makes Us Different