With remarkable speed, the COVID-19 pandemic has accelerated select investment themes across a number of industries. Nowhere is that truer than the media and entertainment sectors where technological advances and work-from-home trends are rapidly changing the landscape.

According to Nathan Meyer, Equity Investment Analyst at The Capital Group, video games should enjoy at least another decade of demographic tailwinds generated by young people playing and spending more, and older people continuing to stay in the game, so to speak. Dramatic advancements in graphics quality, increased access to cloud-based gaming platforms, and the further adoption of in-game monetization efforts should allow video games to continue taking time and wallet share from traditional pay TV companies.

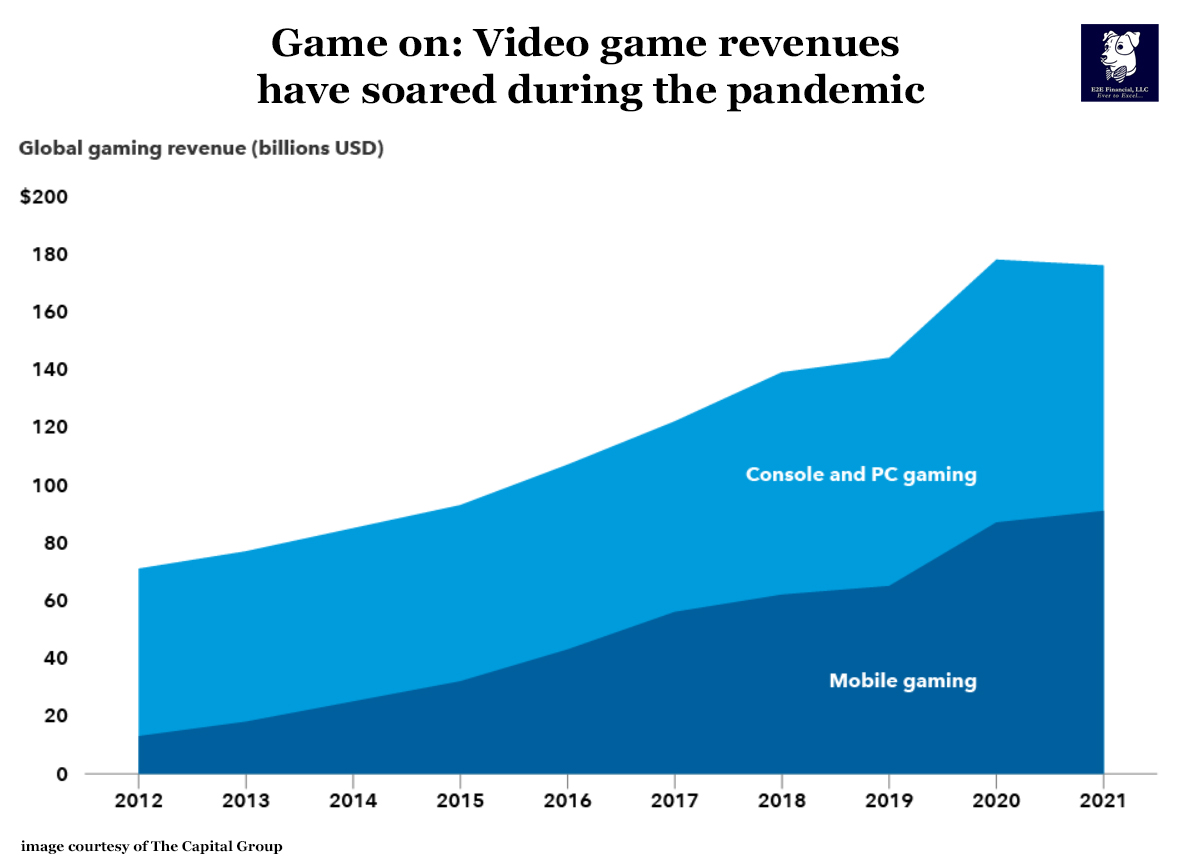

Pandemic-related lockdowns over the past year allowed the gaming industry to shine like never before. Console makers Microsoft (Xbox), Sony (PlayStation) and Nintendo (Switch), as well as game developers such as Activision, Electronic Arts and Take-Two Interactive, experienced huge increases in engagement and revenue as homebound consumers turned to video games for interactive fun and perhaps some degree of escapism.

In Nathan’s estimation, the $130 billion video game industry should be able to sustain a 5% annual growth rate over the next decade. On that path, video games will eventually surpass the $200 billion pay TV market that is growing at just 1% to 2% per year.

Is your portfolio invested in this theme? Reach out to us and get a second opinion!

*The opinions voice in this material are for general information only, and are not intended to provide specific advice or recommendations for any individual. Economic forecasts set forth may not develop as predicted. All investing involves risk, including loss of principal.

All company names noted herein are for educational purposes only, and are not an indication of trading intent, or a solicitation of their products or services.

Because of their narrow focus, sector investing will be subject to greater volatility than investing more broadly across many sectors and companies.