Single-Family Housing Flat in September as Lumber Rises Again

Single-family housing production remained steady in September as strong demand helped offset rising building material prices exacerbated by supply chain disruptions, especially with lumber. On Tuesday, the U.S. Department of Housing and Urban Development and the U.S. Census Bureau reported the following:

Building Permits

- Privately‐owned housing units authorized by building permits in September were at a seasonally adjusted annual rate of 1,589,000.

- This is 7.7% below the revised August rate of 1,721,000, but is virtually unchanged from the September 2020 rate.

- Single‐family authorizations in September were at a rate of 1,041,000

- This is 0.9% below the revised August figure

- Authorizations of units in buildings with five units or more were at a rate of 498,000 in September.

Housing Starts

- Privately‐owned housing starts in September were at a seasonally adjusted annual rate of 1,555,000.

- This is 1.6% below the revised August estimate, but is 7.4% above the September 2020 rate.

- Single‐family housing starts in September were at a rate of 1,080,000; this is virtually unchanged from the revised August figure.

- The September rate for units in buildings with five units or more was 467,000.

Housing Completions

- Privately‐owned housing completions in September were at a seasonally adjusted annual rate of 1,240,000.

- This is 4.6% below the revised August estimate and is 13.0% below the September 2020 rate.

Single‐family housing completions in September were at a rate of 953,000; this is virtually unchanged from the revised August rate. The September rate for units in buildings with five units or more was 280,000.

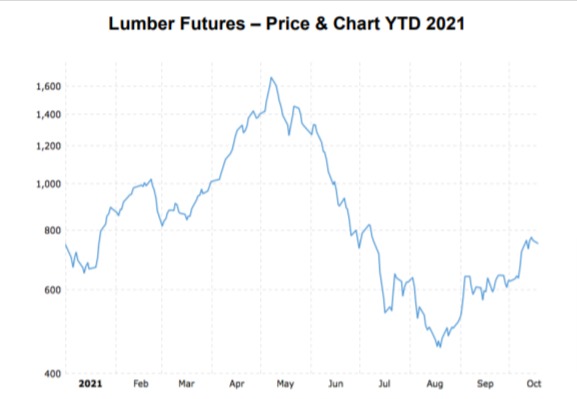

Lumber Prices Climbing Again

According to the National Association of Home Builders: “Single-family construction continued along recent, more sustainable trends in September. Lumber prices have moved off recent lows, but the cost and availability of many building materials continues to be a challenge for a market that still lacks inventory. Policymakers should continue to work to improve supply-chains.”

“Builder confidence increased in October, which confirms stabilization of home construction at current levels. The number of single-family units in the construction pipeline is 712,000, almost 31% higher than a year ago as more inventory is headed to market.”

More Data Later in the Week

More economic data will be released later this week, including the Beige Book on Wednesday; Leading Indicators and the Philadelphia Fed Manufacturing Index on Thursday.