Homeownership Rate Drops From 2020, Consumers Sentiment Stays As-Is and Construction Spending Falls

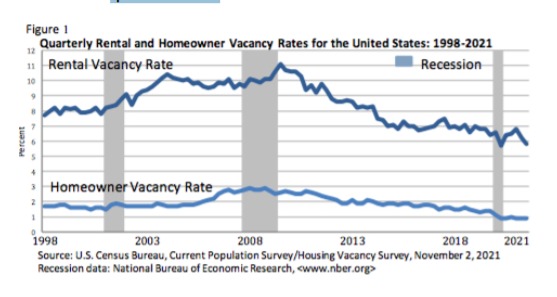

On November 2nd, the U.S. Census Bureau announced the following residential vacancies and homeownership statistics for the third quarter 2021:

- National vacancy rates in the third quarter 2021 were 5.8% for rental housing and 0.9% for homeowner housing

- The rental vacancy rate was 0.6% lower than the rate in the third quarter 2020 and 0.4% lower than the rate in the second quarter 2021

- The homeowner vacancy rate of 0.86% was lower than the rate in the third quarter 2020 and virtually the same as the rate in the second quarter 2021

- The homeownership rate of 65.4% was 2.0% lower than the rate in the third quarter 2020 and virtually the same as the rate in the second quarter 2021

Consumer Sentiment Unchanged

According to the University of Michigan’s Consumer Survey Center, consumer sentiment remained virtually unchanged, gaining just 0.3 index points, and just 0.1 index points above the average in the past two months, and only 0.1 index points below the April 2020 low.

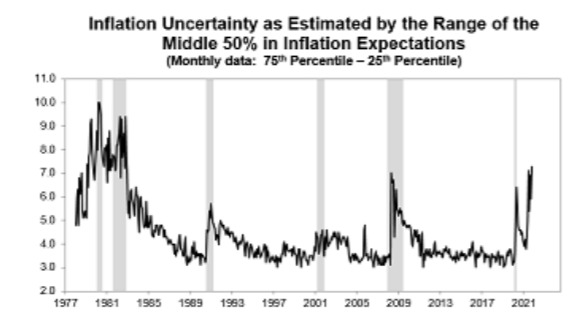

“The positive impact of higher income expectations and the receding coronavirus has been offset by higher rates of inflation and falling confidence in government economic policies. Consumers not only anticipated the highest year-ahead inflation rate since 2008 in the October survey, consumers also expressed greater uncertainty about the year-ahead inflation rate than any time in nearly 40 years.”

“Note that this was the first major spike in inflation uncertainty recorded outside of a recession. Even uncertainty about the long-term inflation rate was the highest in more than a decade. Declining living standards due to inflation were spontaneously mentioned by one-ofevery five households, concentrated among older and poorer households.”

Construction Spending Falls From August

On November 1st, the U.S. Census Bureau announced the following construction statistics for September 2021:

Total Construction

- Construction spending during September 2021 was at an annual rate of $1,573.6 billion

- This is 0.5% below August and 7.8% above September 2020

- During the first nine months of this year, construction spending amounted to $1,177.5 billion, 7.1% above the $1,099.8 billion for the same period in 2020

More Data Later in the Week

More economic data will be released later this week, including the ADP Employment Report on Wednesday and Consumer Credit data on Friday.