We have included a summary of the U.S. Debt Ceiling Debate article written by Lord Abbett. The full article can be found here.

Investors, and the U.S. Federal Reserve (Fed), are increasingly focused on the looming showdown over the U.S. budget and the statutory limit on issuing new debt, popularly known as the debt ceiling. As of this writing, White House and Congressional leaders were conducting negotiations to raise the debt limit from its current $31.4 trillion. Treasury Secretary Janet Yellen has indicated that the U.S. Treasury will likely no longer be able to satisfy all the government’s obligations if Congress has not acted to raise or suspend the debt limit by early June. Any disruption to the timely payment of U.S. fiscal spending obligations or government debts would severely impact financial markets and the U.S. economy—and may reverberate across the global economy.

While the details of this debt-limit debate can seem overwhelming, it’s important to understand the key elements of what is happening and identify the potential implications for financial markets. Here, we will focus on three key questions:

Will the debt ceiling be raised before the government runs out of money?

What can the government do to prevent a U.S. default if the issue is not resolved in time?

If no agreement is reached, what are the potential ramifications for investors?

1. Will the debt ceiling be raised before the government runs out of money?

The answer to that one is a stark and simple “nobody knows.” Twice in the past decade, politicians have failed to come to an agreement before the so-called “X date,” 1 and it seems entirely possible that we will see this happen for a third time. In this political game of chicken, where both sides hope the other will capitulate first, there is a very real possibility that each side believes that growing political and economic pressures—and the possibility of pronounced market volatility—will force the other side to cave first. Moreover, with two prior episodes in which negotiations extended beyond the X date without incurring a total catastrophe, many politicians may feel they can disregard warnings. Meanwhile, the Congressional calendar may be cutting into available time for negotiating, with Congress expected to head into recess on May 26.

2. What can the government do to prevent a U.S. default if the issue is not resolved in time?

Every year, the U.S. government spends far more than it takes in and must increase its outstanding debt to do so. While the government can control the timing of its spending, budget officials can only guess as to the timing of tax receipts. Thus, they can provide only imprecise estimates as to when the government may “run out of money.” Moreover, running into the debt ceiling does not mean that all government functions will come to a halt. It simply means that Washington can no longer spend more than it takes in. At that point, the government will prioritize spending on items deemed essential and may cut lower-priority outlays. The Congressional Budget Office has a considerable amount of useful and publicly available information, including a decomposition of spending into “essential and nonessential” expenditures.

3. Is a technical default even possible? And what are the possible market implications of a government shutdown?

In theory, a “default” on U.S. government debt could have massive ramifications for investors. However, few observers believe a true default—as in, the government saying it will not make good on U.S. sovereign and agency debt—is a possible outcome, for several reasons. First, any issues that might create a technical default are self-inflicted, and come from an easily resolved technicality, not from an actual ability to pay. Also, all parties involved know that the ramifications of default by the most “risk-free” borrower in the world, and linchpin of the global financial system, would be catastrophic for global markets. But even a short-term failure to pay on a timely basis, known as a “technical default,” could create some serious issues for markets and investors, and most analysis focuses on the implications of this latter scenario.

How might a technical default impact the broader fixed income and currency markets? The consensus is that long-term Treasury yields would decline, credit spreads would widen, and the U.S. dollar would weaken relative to other major developed currencies, according to a recent polling of investors by JP Morgan.

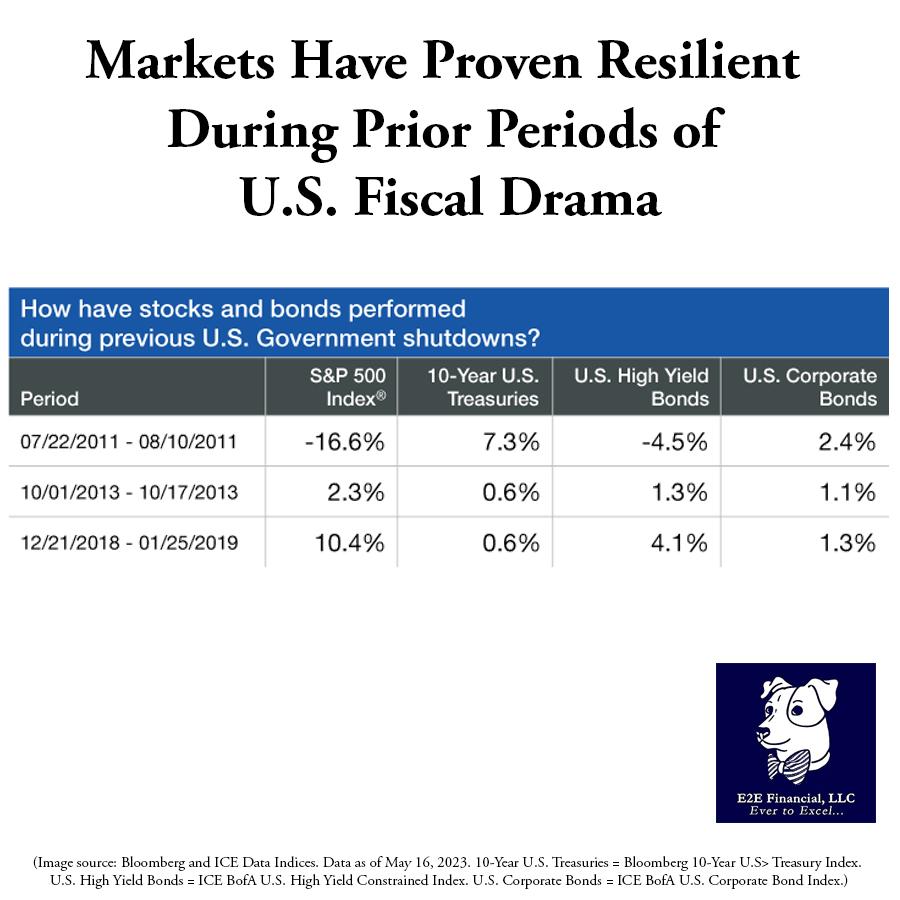

Here, we think it would be useful to look at the experience of financial markets during past periods of U.S. budget turmoil. The included spreadsheet shows the performance of U.S. stock and bond benchmarks during the last three government shutdowns: 2011 (first Obama Administration), 2013 (Obama second term), and late 2018-early 2019 (Trump Administration). In the 2013 and 2018 shutdowns, we can see that markets did just fine. However, we have no great template for considering what might happen in the event of a technical default. Some analysis considers market performance when the United States was downgraded in 2011, as many observers reasonably assume that a technical default might result in a ratings downgrade. However, the few weeks that followed the 2011 S&P downgrade were quite turbulent; this period also coincided with the early stages of the European debt crisis, which dominated investor attention. Indeed, a decline in Treasury yields (as we saw in 2011) is an odd reaction to a credit downgrade and illustrates both the unique standing of U.S. Treasuries as a haven asset and the fact that, at least in this case, an issuer’s lowered credit rating did not seem to matter to investors.

We would prefer that our elected officials not put us in this pickle and reach a compromise. If you care to reach out to your elected official, click here to find them and call/email them. In the meantime, we at E2E Financial are here to answer any of your questions.

Your weekly market update is here.

Sources: Source: Lord Abbett

1-”X date” refers to the estimated date that the U.S. Treasury may no longer be able to fulfill its obligations if the U.S. borrowing limit is not increased.