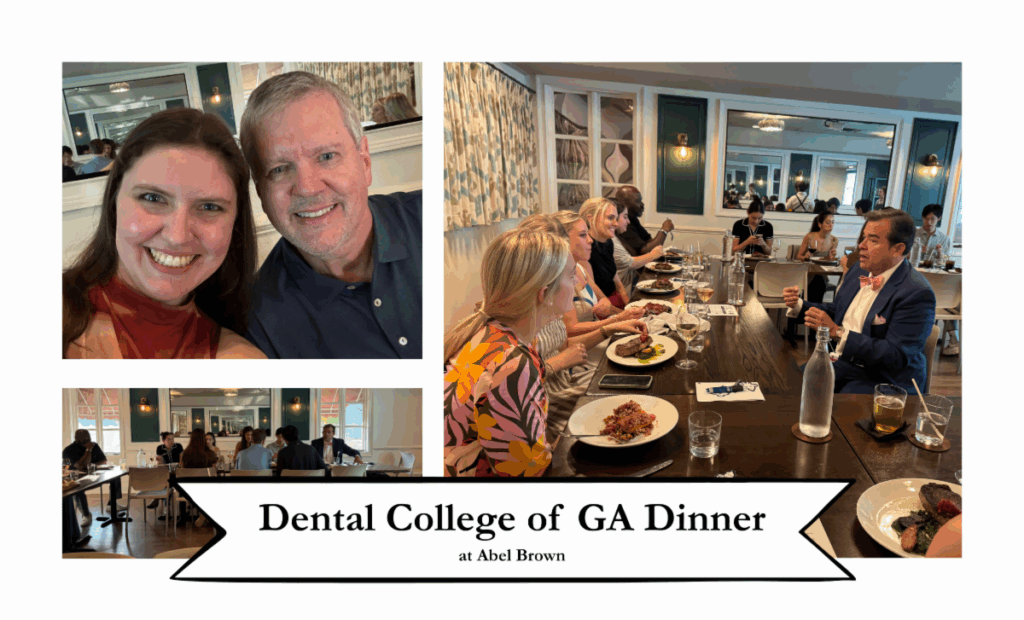

This week we had the privilege of connecting with the next generation of dentists over a wonderful dinner at Abel Brown. We were joined by several Dental College of GA students who were eager to learn tips on how to create a powerful financial future.

Conversations like these reminded us how important it is to stay engaged with dentistry at every stage. From new dentists to seasoned practice owners we are here to help you every step of the way.

Wherever you are in your career here are some ways we can help:

Students and New Dentists. Starting out strong is key. Protecting your future income with disability income insurance and assembling a dental-specific advisory team can set you up for long-term success. Download our new dentists checklist for a complete list of ideas to help you start your career with confidence.

Associate Dentists and New Owners. Building your foundation is key. We’ll guide you through financial planning, cash flow management, and setting up benefits like a 401(k) plan. If you’re curious whether you’re on the right track, download our new owner/associate checklist to see the key steps every dentist should be taking.

Experienced Practice Owners. We can support with retirement planning, advanced tax strategies working with your CPA, and exit planning so you can make the most of everything you’ve built.

What sets E2E apart is we understand dentistry. Your financial plan needs to incorporate your dental practice(s). We take that as the foundation of your coaching and planning. Are you in one of these stages and looking for dental focused guidance? Reach out to schedule your complimentary consultation.

We’re here to help you pursue your financial goals no matter what stage you’re at in life. Proper planning helps set you up for success!