MARKETS RETREAT ON THE WEEK AS YIELDS CREEP HIGHER, THE FED MAINTAINS ITS DOVISH STANCE AND OIL LOSES $4/BARREL

- The four major U.S. stock indices retreated on the week, with the smaller-cap Russell 2000 losing the most as it gave back 2.8%

- The larger cap S&P 500 and DJIA both reached closing highs early in the week, but then retreated modestly, losing 0.8% and 0.5%, respectively

- NASDAQ also lost 0.8% on the week

- Wall Street seemed most interested in this month’s Fed-meeting and as expected, the Fed opted to leave the fed funds rate as is, but Fed Chair Jerome Powell did calm Wall Street somewhat with his dovish tone

- While Powell reiterated the Fed’s patient monetary policy approach, he indicated that rates might remain unchanged into 2024, unless there was substantial change in employment and inflation

- Throughout the week, the 10-year Treasury rose, coming close to 1.76% but ultimately ending up at 1.72%, a full 10 basis points higher than the week before

- Of the S&P 500 sectors, higher rates pushed down the Financials sector (-1.7%) and the Information Technology sector (-1.4%)

- Of the other 6 sectors that declined on the week, the Energy sector was hammered as it lost 7.7%, which many attribute to profit-taking after such large increases over the past few months

- West Texas Intermediate Crude lost about $4 on the week and closed Friday at $61.42/barrel

- February Retail Sales, Housing Starts and Industrial Production all came in less robust than expected, but the Philadelphia Fed Index leapt to 51.8

Rising Rates Placing a Damper on Markets

After the first few days of trading this week, investors were hopeful that the momentum to record highs might continue, but as bond yields reached their highest level in a year, the stock markets retreated. And as rates moved up, the sectors that one would expect – namely Financials and Information Technology – moved down.

But it was the Energy sector that dropped dramatically as oil prices saw their biggest daily drop since last summer. Oil was fueled by rising U.S. inventories and worry about nearterm demand, but the Energy sector as a whole was also hit by profit-taking.

Much of the week’s economic data was not so great, especially as recent Retail Sales data and Housing Starts came in much softer than expected. And while there are lots of positives to note in the fight against the pandemic, including that the U.S. would reach 100 million vaccines and positive trend lines, there was worry about variants, especially with scenes of spring-breakers frolicking on beaches without masks and with no regard for social distancing.

But the spring breakers did contribute to the Transportation Safety Administration reporting that daily airline passenger volumes reached their highest level since the start of the pandemic, so there’s that.

The Fed Soothes Markets

Federal Reserve Chair Jerome Powell soothed Wall Street this week shortly after our central bank concluded their two-day meetings.

As inflation concerns were creeping into Wall Street’s collective worries, Powell managed to ease concerns (at least temporarily) and shared a glass-half-full economic outlook too. In short, Powell shared that:

- The Fed expects to maintain close-to-zero rates over the next 3 years;

- The Fed expects to maintain its accommodative policy until it meets its employment and inflation targets;

- The Fed’s employment target is maximum employment; and

- The Fed’s inflation target is 2%, but Powell said he anticipates inflation going beyond 2% in the shortterm.

All told, Powell was optimistic that economic growth was healthy and expected that growth to continue.

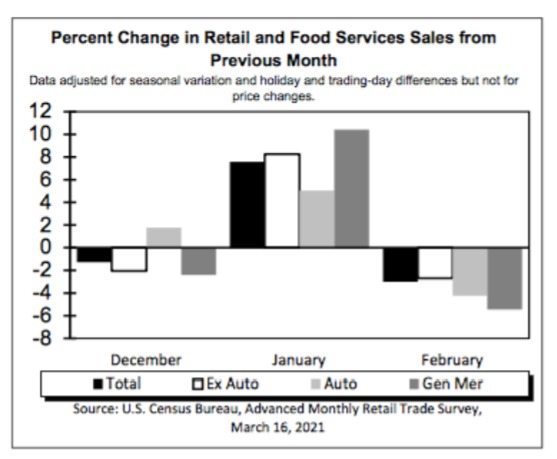

Retail Sales Drop 3% in February

On March 16th, the U.S. Census Bureau announced that advance estimates of U.S. retail and food services sales for February 2021 were $561.7 billion, a decrease of 3.0% from January, but 6.3% higher relative to February 2020.

By many accounts, Retail Sales was expected to fall back after January’s surge, inflated by federal stimulus payments, but February’s decline was more than expected. That being said, Wall Street reacted negatively to the fact that sales at gasoline stations (+3.6%) was the only category posting gains in February (inflated by higher gas prices).

Other categories showed steep declines, including:

- Department stores (-8.4%);

- General merchandise (-5.4%);

- Motor vehicles (-4.2%); and

- Restaurants (-2.5%).