With the S&P 500 Index near record highs, have we moved past peak dominance for the Magnificent Seven (“Mag 7”) group of stocks? It appears so, and it represents a healthy move away from the extreme concentration that raised concerns about risks to investor portfolios.

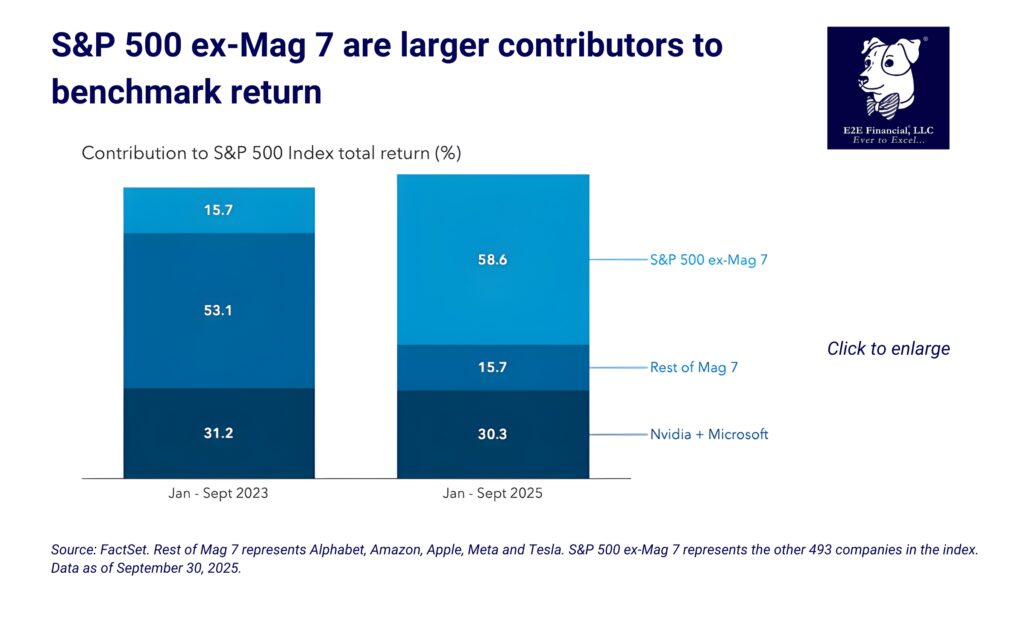

After three years of the Mag 7 accounting for a majority of the S&P 500’s annual return, more companies are now contributing; by September 30, non-Mag 7 stocks represented 59% of this year’s return.

Fresh breadth may support the S&P 500’s rebound after its early 2025 selloff. The index has surged 36% since hitting an April 8 low. Rising valuations among companies in the index and more clarity on tariffs and interest rate cuts could help lift the U.S. equities market, which has trailed those in Europe and elsewhere.

“Heading into 2026, I think there are tailwinds that should drive earnings growth and support the market, such as stimulus from the tax bill and more policy certainty,” says Diana Wagner, equity portfolio manager at Capital Group. “There’s plenty of opportunity outside the Mag 7, and I think the broadening that we have started to see this year is going to continue.”

1. Market breadth is widening

Market breadth is on the rise since touching a low in June 2023, when the Mag 7 dominated returns for the S&P 500.

2. Nvidia is changing the equation

The meteoric rise of Nvidia, which has a near-monopoly on data center semiconductors fueling the AI boom, has catapulted the likes of Apple, Microsoft and Alphabet (parent of Google) to claim the title as the world’s most valuable company at $4.5 trillion.

3. Valuations are less divergent

After significant divergence two years ago, forward price-to-earnings parity is slowly increasing, indicating that long-term growth projections are edging closer. The Mag 7 stocks traded at 31 times forward earnings on a 12-month basis as of September 30 vs. 20 times for the other 493 companies.

4. Where the market may broaden

Market pressures — like AI disruption, manufacturing slowdowns outside data center development and higher interest rates — have compressed valuations in some sectors.

Click here to read the full article from Capital Group.

Diversification is key to long-term investing success, time for a second opinion? Get a side-by-side comparison free of charge. Schedule your complimentary consult here.

Plus, your weekly market update is here.