Officials at the world’s major central banks — chiefly, the U.S. Federal Reserve and the European Central Bank — are watching closely as these events unfold. The ECB has already started cutting rates, and many investors believe the Fed will too, as tariffs threaten economic growth. However, rising consumer prices are making that decision difficult, since lower rates could reignite inflation.

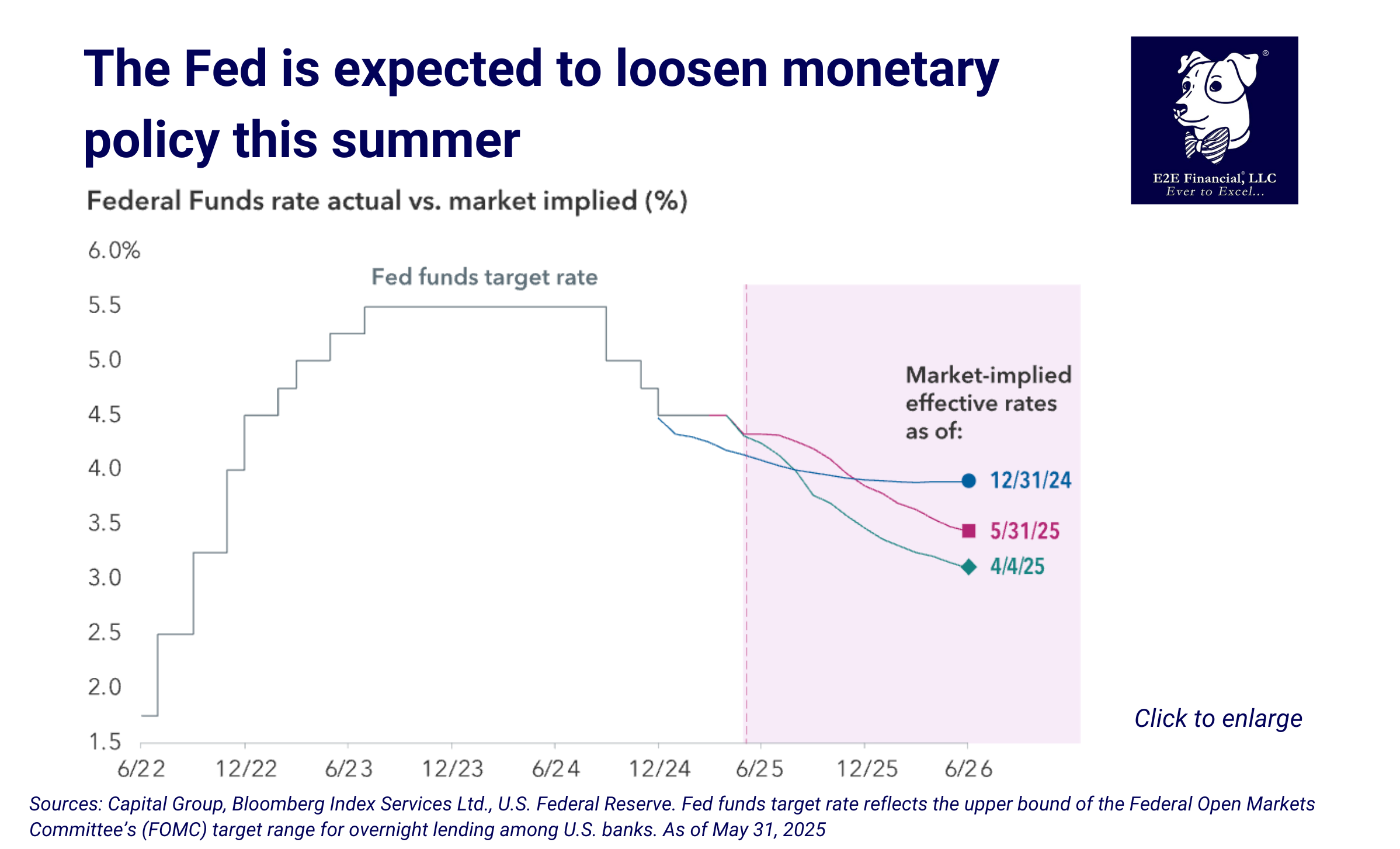

In the U.S., inflation has remained stubbornly high in recent months, hovering around 2.5% to 3% on an annualized basis. That’s above the Fed’s 2% target. Even so, bond investors are expecting the Fed’s first rate cut of the year to come in July, followed by two or three more before the end of the year.

“While the U.S. economy is showing some signs of slowing, employment remains strong, so the Fed probably isn’t likely to take action too quickly or too aggressively,” says Chitrang Purani.

“As long as labor markets don’t materially weaken, the Fed has good reason to stay patient with inflation remaining above target,” Purani explains. He views current market pricing of the federal funds rate at around 3.8% by the end of the year, down from roughly 4.3% today, as a fair level based on the balance of risks.

“I do expect U.S. growth and global growth to slow in the face of tariffs and trade war uncertainty,” he adds, “but I think it’s too early to call for a recession.” Read more from the Capital Group.

TAKE CONTROL in times of uncertainty. Schedule your complimentary consultation with us today.

Plus, your weekly market update is here.