Fast-growing digital and tech companies generated a lot of investor excitement over the past decade, not to mention an outsized share of market returns.

Since the start of 2022, however, many of these market darlings have taken a beating. Amid slowing economic growth, soaring inflation and the fear of rising interest rates, investors may be taking a second look at the high valuations many digital platform and software stocks command.

“This is one of the most complex environments for investing we have seen in years,” says Capital Group’s equity portfolio manager Jonathan Knowles. “With questions lingering over the persistence of inflation and shifts in the geopolitical landscape, I am looking to invest in an ‘all weather portfolio’ with the potential to withstand a variety of potential risks.”

That’s why boring is beautiful according to Knowles. “I’m looking to invest in dull and dependable companies with the potential to generate solid cash flows and continue growing regardless of the direction of the economic cycle or macroeconomic developments.”

There are several investment themes that cautious investors may want to consider. We’ll be covering them over the coming weeks. Here’s one to start you off….

Railroads are riding a commodities boom

You can’t build the new economy without old industries.

Long-term shifts toward a digital future, the rollout of electric vehicles and the transition to clean energy will likely continue to drive opportunity for innovators in those areas. But these trends are also providing tailwinds for old industries like mining and railroads.

Nickel, for example, is a key component in electric vehicle batteries. So is copper, which is necessary for updating the electric grid. And while software is becoming an increasingly essential player in the production of modern cars, steel remains a required component. Indeed, prices for select commodities have skyrocketed in recent months, a trend amplified by the war between Russia and Ukraine — major producers of nickel, copper and grains.

“People have underappreciated how much copper is needed to rewire and modernize the electric grid as demand rises,” says Capital Group’s equity portfolio manager Andrew Suzman. “Businesses like Canadian metals and mining company First Quantum Minerals, which focuses on copper, and Brazil’s Vale, a producer of iron ore, could benefit.”

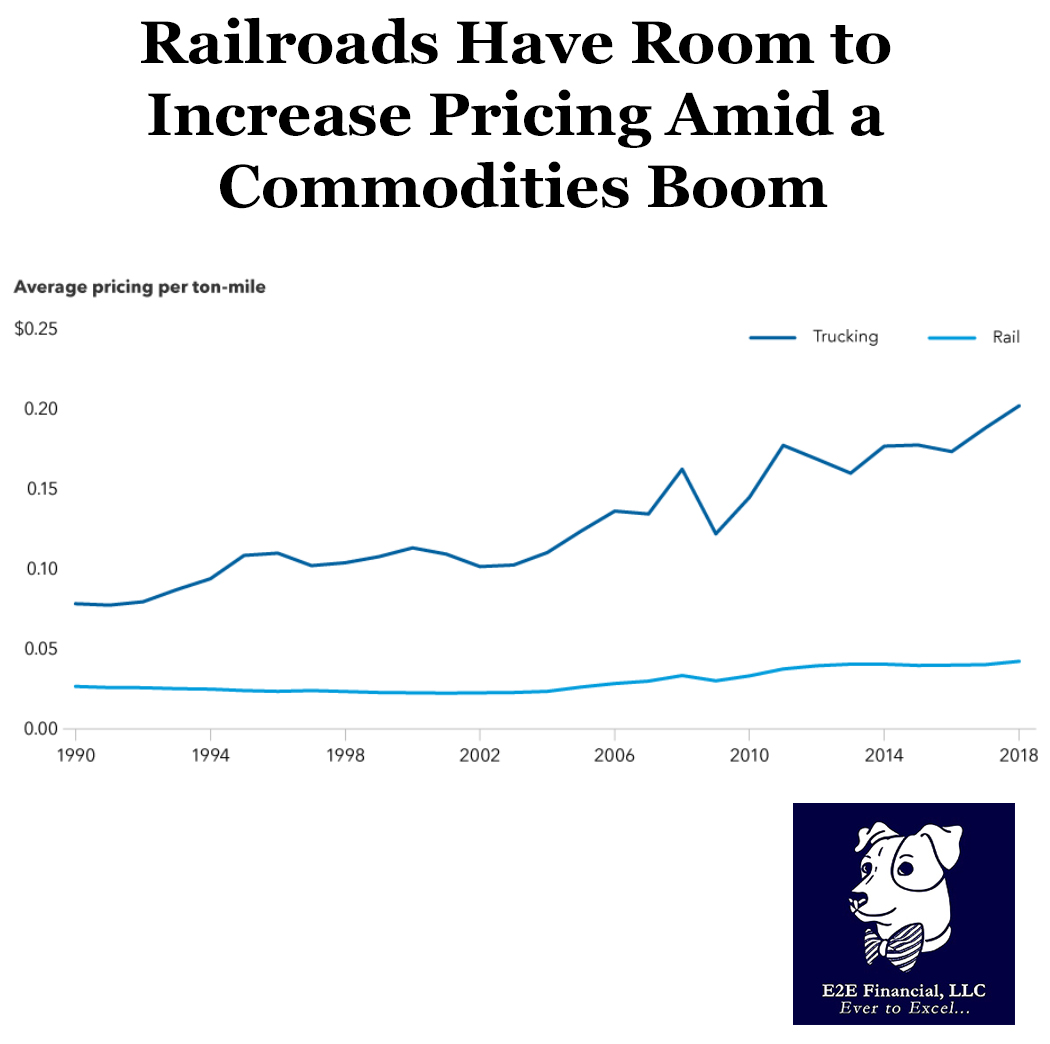

Rising demand for commodities and energy could also boost demand for North America’s railroads, which are the most cost-effective way to transport heavy materials. Railroads have pricing power potential as well, which is important in today’s inflationary environment. They typically base their pricing on the cost of the underlying commodities they are hauling, so revenues rise with commodity prices.

Rising fuel costs also prove beneficial, as the difference between the cost of trucking and rails is at its widest gap in years. “A railroad like Canadian Pacific, which has the only tri-coastal Canada-U.S.-Mexico network, could do well under a variety of economic circumstances,” Suzman adds.

It is currently a uncomfortable ride in the investment markets. We, at E2E Financial, are here to help. We use Capital Group (and their American Funds) as part of our investment portfolios. Want to learn more? Click here to schedule an complimentary appointment.

Source: Capital Ideas