As the U.S. economy heads into the final months of a tumultuous year, all eyes are on American consumers. Can they continue to power through despite weaker job growth and slower wage increases? Or will they tighten their purse strings amid rising tariffs and higher inflation?

Healthy earnings for several companies in the S&P 500 Index suggest the economy remains resilient. But there are signs that shoppers are being more selective about their purchases, and that many companies won’t be able to absorb tariff-related price hikes much longer.

Second-quarter results shed light on how consumers are behaving and what they are buying. “It’s a dizzying mosaic of news, but corporate earnings can provide real-world insights into the progress of long-term investment themes,” says Hilda Applbaum, an equity portfolio manager for American Balanced Fund®.

Below are three themes that warrant a closer look:

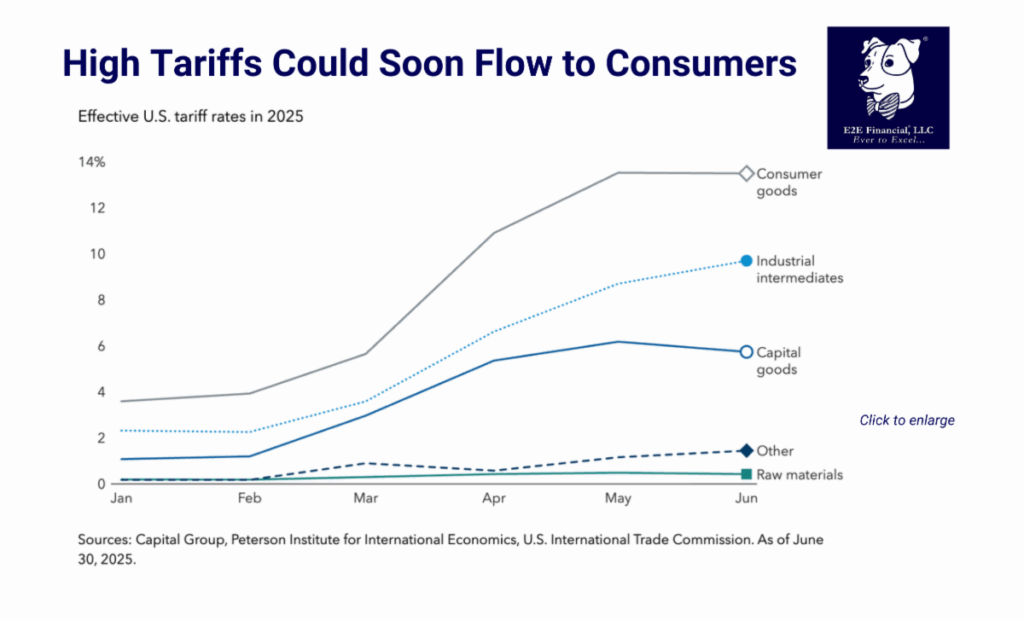

1. Consumers can likely absorb tariffs

Shoppers may soon notice higher prices, but they’re better prepared than you might think. According to Applbaum, with favorable debt-to-income ratios and potential relief from tax refunds and rate cuts, many households could manage modest price increases.

2. Homeowners could turn to remodeling

Will modest interest rate cuts prompt consumers to reenter the housing market? The question looms large over an industry mired in a prolonged sales slump.

3. Tariffs scramble playbook for consumer brands

From tariffs to evolving consumer preferences to more frequent weather-related disruptions, companies are navigating tremendous volatility. Some are leveraging their strengths while others are suffering from their unique vulnerabilities.

Read more here. Time for a second opinion on your financial planning and investment portfolios? Schedule your complimentary review here.

Plus, your weekly market update is Here.