The U.S. economy appears to be heading back to the future. Here’s what Capital Group has to say…

“In the 2008 movie, The Curious Case of Benjamin Button, the title character played by Brad Pitt ages in reverse, transitioning over time from an old man to a young child. Oddly enough, I think the U.S. economy is doing something similar.

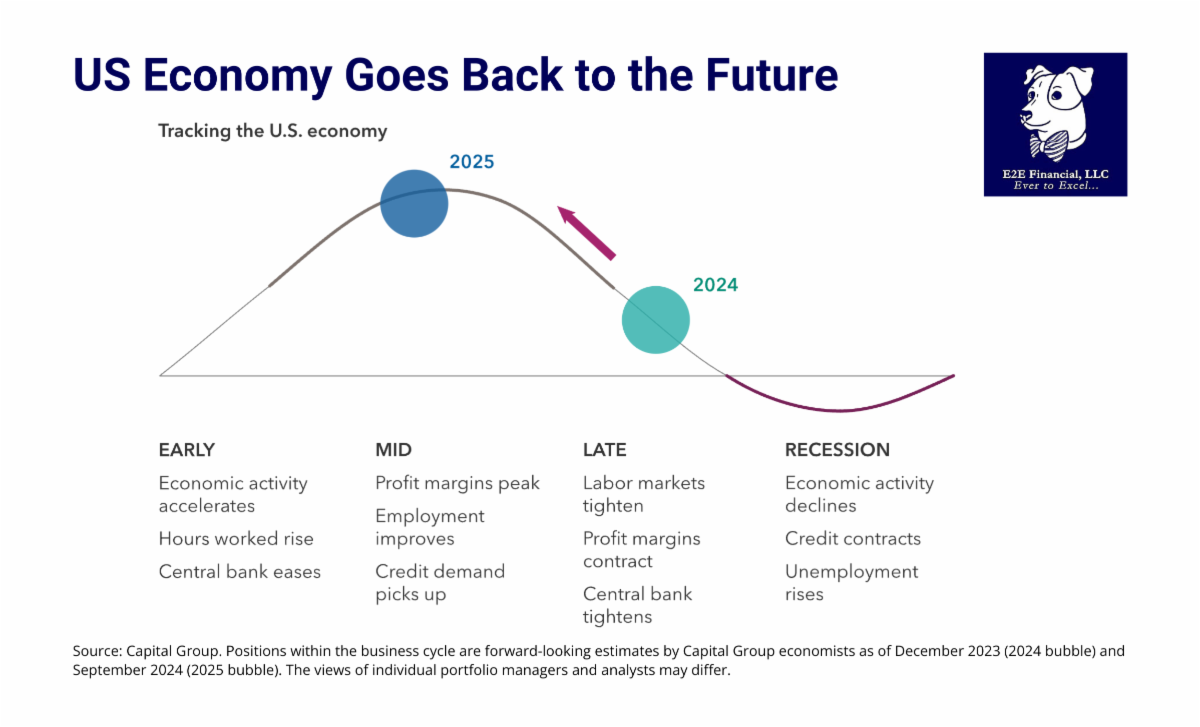

Instead of the typical four-stage business cycle — early, mid, late and recession — we have witnessed since the end of World War II, the economy appears to be transitioning from late-cycle characteristics of tight monetary policy and rising cost pressures back to mid-cycle, where corporate profits tend to peak, credit demand picks up and monetary policy is generally neutral.

The next step should have been recession but, in my view, we have clearly avoided that painful part of the business cycle and essentially moved backward in economic time to a healthier condition.

How did this happen? Much like the movie, it’s a bit of a mystery, but I think the Benjamin Button economy has resulted largely from post-pandemic distortions in the U.S. labor market that were signaling late-cycle conditions. However, other broader economic indicators that I think may be more reliable today are flashing mid-cycle.

If the U.S. economy is mid-cycle, as I believe, then we could be on the way to a multi-year expansion period that may not produce a recession until 2028. In the past, this type of economic environment has produced stock market returns in the range of 14% a year and provided generally favorable conditions for bonds.”

Curious about what this means for your portfolio? Click here to read more.

Are you prepared for these changes? Reach out to us to schedule your free consultation.

Plus, your Weekly Market Update is here!