The Federal Reserve (aka FOMC) has cut interest rates. What does it mean? Hear from Capital Group on their take….

The U.S. Federal Reserve has finally arrived at the rate-cut party.

Officials at the central bank lowered interest rates 50 basis points to 4.75% to 5.00%, the first cut since March 2020, when the COVID-19 pandemic shuttered most of the world’s economy. Although households, companies and governments hurt by high borrowing costs may cheer the move, investors are now faced with the challenge of figuring out what’s next.

“Historically, when the Fed starts to cut it’s a red flag. Rate cuts take a long time to flow through the economy, so it’s less about the rate changing and more about what the Fed sees and what the economy is doing,” says Caroline Jones, Capital Group portfolio manager, “The language from Fed Chair Jerome Powell is just as important, and he struck a balanced tone consistent with a soft landing.”

The Fed has now joined other major central banks including the European Central Bank, which began the process of lowering rates in June and did so again in September as inflation declined. Worldwide, policymakers are grappling with growth concerns, though Europe’s economy is more stagnant.

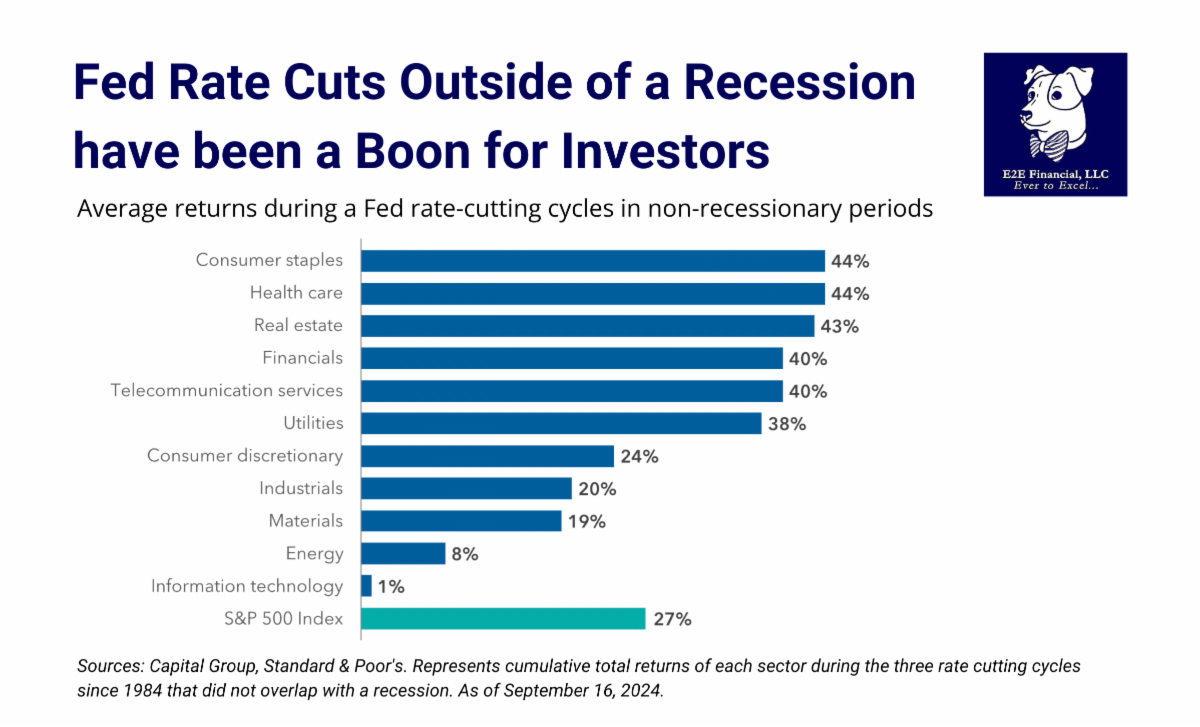

Many investors, including Jones, don’t expect a recession in the U.S. as the most likely outcome. “However, the pandemic and ensuing monetary tightening campaign to curtail inflation created unusual distortions, so everything feels messier,” she adds. Coupled with a rate cut in the thick of a presidential campaign, investors are likely to face some market volatility in the months ahead. “Now that we have the first rate cut, investors in the market are likely to start positioning for the election as the next big event.”

Are you well positioned for the rate cut? Reach out to us to schedule your free consultation.

Your Weekly Market Update is here. Plus, read more about the recent rate cut and what it could mean for you.