MARKETS SHAKE OFF A BIG EARLY WEEK DECLINE TO END THE WEEK MODESTLY UP AS THE FED MAINTAINS ITS ACCOMODATIVE POLICIES

- The markets endured a rocky week, declining more than 3% early in the week before slowly rallying to end the week with modest gains

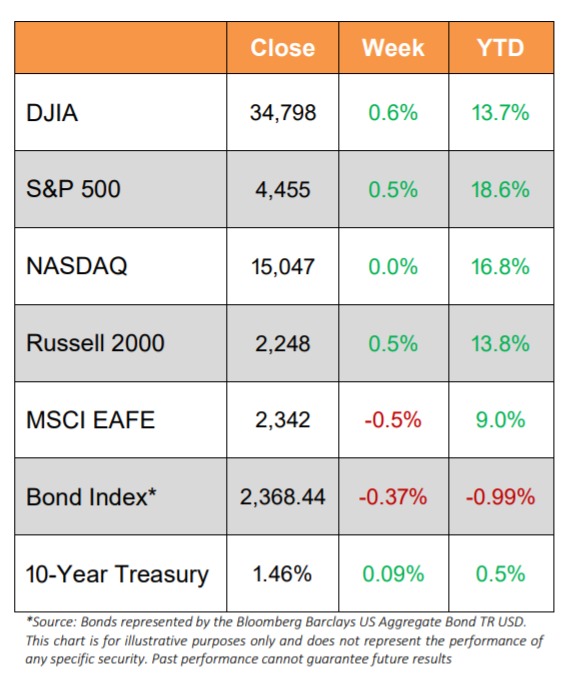

- The DJIA advanced 0.6%, while the large-cap S&P 500 and the small-cap Russell 2000 both moved up 0.5% whereas NASDAQ was essentially flat

- Most of the S&P 500 sectors were up this week as 9 of the 11 advanced, with Energy (+4.7%) and Financials (+2.2%) topping the list and Real estate (- 1.5%) and Utilities (-1.2%) at the bottom

- There was a decent amount of economic news, but Wall Street seemed especially focused on China’s Evergrande, a property developer that was rumored to be close to defaulting on $300 billion in debt

- While most indications are that the Evergrande problem will be contained, naysayers were quick to bring comparisons to Lehman Brothers, which collapsed 13 years ago to the day and kicked off the Financial Crisis of 2008

- The economic news received was mostly better than expected, as new home sales, existing home sales, and housing starts all beat expectations

- The Fed was in the news again this week and Wall Street interpreted the Fed’s comments as accommodative, despite the Fed really not giving any indication as to when its tapering might begin

- The 10-year Treasury yield moved up to end the week at 1.46%

- Despite major movements in the U.S. stock indices, the Volatility Index, as measured by the VIX, trended down significantly from north of 25 early in the week to about 17

- WTI Crude added another $2 to the price of a barrel, just as it did last week, ending the week just shy of $74/barrel

Stocks Dust-off Monday’s Big Decline and End Higher for the Week

The major U.S. equity benchmarks shook off a big decline on Monday and ended the week with modest gains. But after the close on Monday, it looked as if a bigger decline was imminent as the S&P 500 recorded its worst drop since midMay and dipped below its 100-day average.

Monday’s decline really did seem tied to worries that the second largest property developer in China would default on hundreds of billions in debt and that it would spread to other markets around the world. But by Wednesday, Wall Street had decided that the fallout would be mostly contained to China and markets moved steadily up, clawing out small gains by the time Friday’s closing bell was struck.

The other news on the week, besides a lot of housing data, was the Fed’s policy meeting. Markets were tense that the Fed might taper its bond buying program sooner, but the only timetable out of the Fed was that the tapering would begin “soon.” In his post-meeting press conference, Fed Chair Powell reiterated that the Fed would be looking for continued improvement in the labor market before acting.

And while the Fed held short-term rates as is, projections for a rate increase are now evenly split between next year and 2023. Plus, most officials expect at least three 25 basis point rate hikes by the end of 2023.

Housing Continues Its Red-Hot Pace

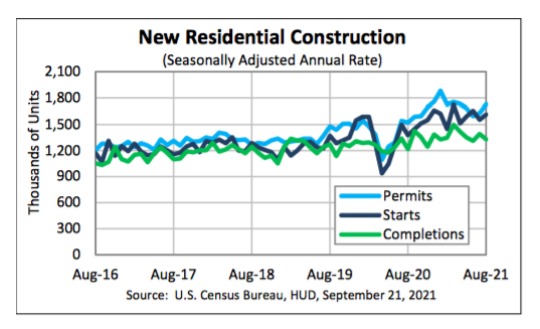

On Tuesday, the U.S. Census Bureau and the U.S. Department of Housing and Urban Development jointly announced strong housing data.

Building Permits

- Privately‐owned housing units authorized by building permits in August were 1,728,000.

- This is 6.0% above the revised July rate of 1,630,000 and is 13.5% above the August 2020 rate of 1,522,000.

- Single‐family authorizations in August were at a rate of 1,054,000; this is 0.6% above the revised July figure of 1,048,000.

- Authorizations of units in buildings with five units or more were at a rate of 632,000 in August.

Housing Starts

- Privately‐owned housing starts in August were 1,615,000.

- This is 3.9% above the revised July estimate of 1,554,000 and is 17.4% above the August 2020 rate of 1,376,000.

- Single‐family housing starts in August were at a rate of 1,076,000; this is 2.8% below the revised July figure of 1,107,000.

- The August rate for units in buildings with five units or more was 530,000.

Housing Completions

- Privately‐owned housing completions in August

were 1,330,000.

- This is 4.5% below the revised July estimate of 1,392,000, but is 9.4% above the August 2020 rate of 1,216,000.

- Single‐family housing completions in August were at a rate of 971,000; this is 2.8% above the revised July rate of 945,000.

- The August rate for units in buildings with five units or more was 356,000.

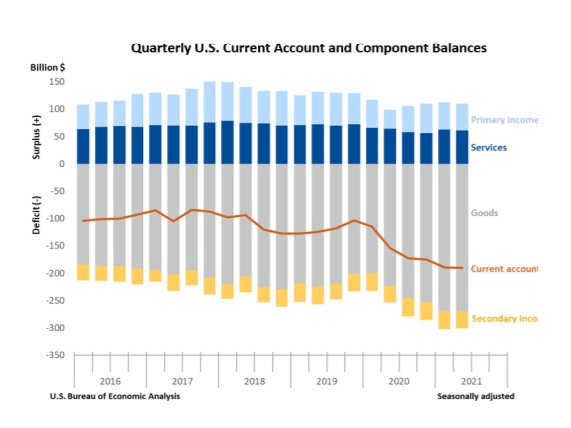

Current Account Deficit Widens in the Second Quarter

On Tuesday, the U.S. Bureau of Economic Analysis announced that “the U.S. current account deficit, which reflects the combined balances on trade in goods and services and income flows between U.S. residents and residents of other countries, widened by $0.9 billion, or 0.5%, to $190.3 billion in the second quarter of 2021.

The second quarter deficit was 3.3% of current dollar gross domestic product, down from 3.4% in the first quarter. The $0.9 billion widening of the current account deficit in the second quarter mainly reflected reduced surpluses on services and on primary income that were mostly offset by a reduced deficit on secondary income.”

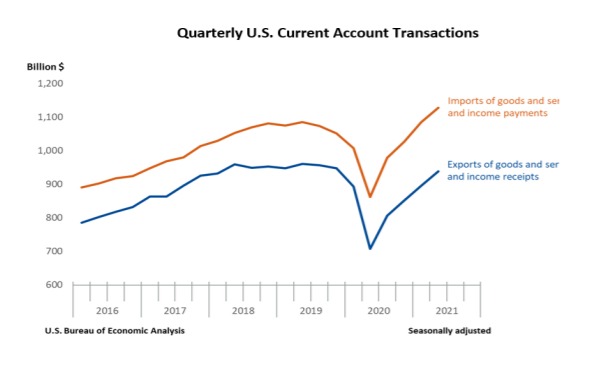

Exports & Imports of Goods and Services

- “Exports of goods increased $28.3 billion, to $436.6 billion, mostly reflecting increases in industrial supplies and materials, mainly petroleum and products, and in capital goods, mainly civilian aircraft and semiconductors.

- Imports of goods increased $29.0 billion, to $706.3 billion, primarily reflecting an increase in industrial supplies and materials, mainly petroleum and products and metals and nonmetallic products.

- Exports of services increased $7.6 billion, to $189.1 billion, primarily reflecting an increase in travel, mostly other personal travel.

- Imports of services increased $9.1 billion, to $127.8 billion, mostly reflecting increases in transport, primarily sea freight and air passenger transport, and in travel, primarily other personal travel.”