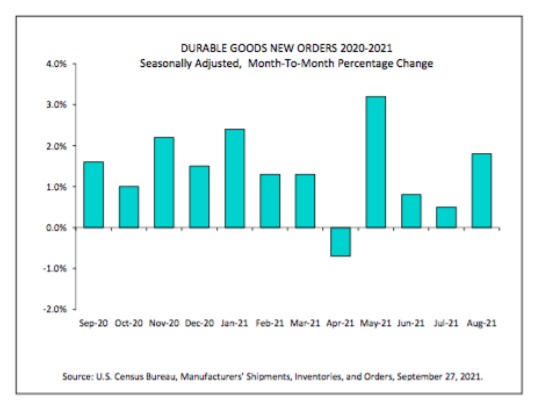

Durable Goods Up 15 of the Last 16 Months and Up 1.8% in August

Durable goods orders are new orders placed with domestic manufacturers for factory hard goods. In addition, the report compiled by the U.S. Census Bureau also contains information on shipments, unfilled orders and inventories. The advance release provides early estimates and is revised about a week later by the factory orders report.

On September 27th, the U.S. Census Bureau announced the August advance report on durable goods manufacturers’ shipments, inventories and orders.

New Orders

New orders for manufactured durable goods in August increased $4.6 billion or 1.8% to $263.5 billion.

- This increase, up fifteen of the last sixteen months, followed a 0.5% July increase.

- Excluding transportation, new orders increased 0.2%.

- Excluding defense, new orders increased 2.4%

- Transportation equipment, up three of the last four months, led the increase, $4.2 billion or 5.5% to $80.8 billion.

Shipments

Shipments of manufactured durable goods in August, down following three consecutive monthly increases, decreased $1.2 billion or 0.5% to $256.1 billion. This followed a 2.0% July increase. Transportation equipment, down following two consecutive monthly increases, drove the decrease, $2.0 billion or 2.7% to $73.5 billion.

Unfilled Orders

Unfilled orders for manufactured durable goods in August, up seven consecutive months, increased $11.8 billion or 1.0% to $1,239.3 billion. This followed a 0.5% July increase. Transportation equipment, up six of the last seven months, led the increase, $7.3 billion or 0.9% to $820.8 billion.

Inventories

Inventories of manufactured durable goods in August, up seven consecutive months, increased $3.4 billion or 0.8% to $457.9 billion. This followed a 0.8% July increase. Transportation equipment, also up seven consecutive months, led the increase, $1.3 billion or 0.8% to $153.4 billion.

Capital Goods

Nondefense new orders for capital goods in August increased $7.4 billion or 9.0% to $89.9 billion. Shipments increased $0.2 billion or 0.3% to $79.4 billion. Unfilled orders increased $10.5 billion or 1.4% to $754.9 billion. Inventories increased $0.9 billion or 0.4% to $201.2 billion. Defense new orders for capital goods in August decreased $1.0 billion or 8.3% to $11.4 billion. Shipments decreased $0.3 billion or 2.3% to $12.4 billion. Unfilled orders decreased $0.9 billion or 0.5% to $187.7 billion. Inventories increased $0.2 billion or 0.8% to $21.0 billion.

More Data Later in the Week

More economic data will be released later this week, including Pending Home Sales on Wednesday; GDP and Jobless Claims on Thursday and Construction Spending and Consumer Sentiment on Friday.