Small Businesses Feeling Less Optimistic as Hiring & Supply Chain Disruptions are Having an Impact

There are over 30 million small businesses in the United States, according to the Small Business Administration and small businesses comprise about 99% of all U.S. businesses.

Further, about half of all Americans – 48% – are employed by small businesses, meaning almost 60 million employees in the U.S. work for a smaller company.

Small Businesses Feeling Less Optimistic

On November 9th, the National Federation of Independent Business reported that its NFIB Small Business Optimism Index dropped in October by 0.9 points to 98.2. One of the 10 Index components improved, seven declined, and two were unchanged.

Key findings include:

- The NFIB Uncertainty Index decreased seven points to 67.

- Small business owners expecting better business conditions over the next six months fell four points to a net negative 37%. This indicator has declined 17 points over the past three months to its lowest level since November 2012.

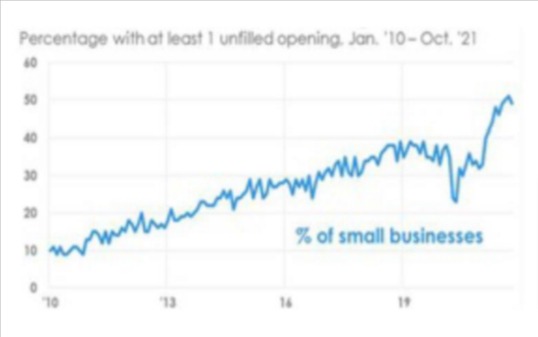

Hiring Remains a Challenge

As reported by the NFIB:

- 49% of owners reported job openings that could not be filled, a decrease of two points from September

- A net 44% of owners (seasonally adjusted) reported raising compensation, a 48-year record high reading

- A net 32% plan to raise compensation in the next

three months

Can small businesses hire enough workers?

Small Businesses Spent Money

Most (56%) business reported capital outlays in the last six months, up three points from September. Of those making expenditures:

- 40% reported spending on new equipment

- 24% acquired vehicles

- 14% improved or expanded facilities

- 12% spent money for new fixtures and furniture

- 7% acquired new buildings or land for expansion

Supply Chain Disruptions

- 39% of owners reported that supply chain disruptions have had a significant impact on their business

- 29% reported a moderate impact

- 21% reported a mild impact

- 10% of owners reported no impact from recent supply chain disruptions

More Data Later in the Week

More economic data will be released later this week, including CPI data and Jobless Claims on Wednesday and Consumer Sentiment and the JOLTS Report on Friday.