JOLTS Report Paints Crazy Picture

The Labor Department creates the Job Openings and Labor Turnover Survey – the JOLTS Report – which tracks monthly changes in job openings as well as job offerings and “quits.”

Unlike other reports that track employment data, the JOLTS reporting period lags by a month, although it does provide additional color to the employment landscape.

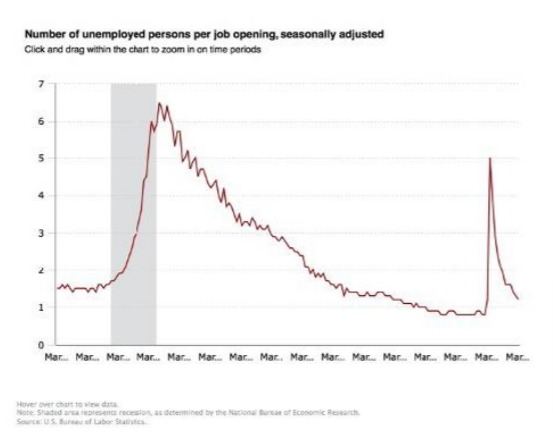

On Tuesday, May 11th, it was reported that the number of job openings reached a series high of 8.1 million on the last business day of March. Further:

- Hires were little changed at 6.0 million.

- Total separations were little changed at 5.3 million.

- Within separations, the quits rate was unchanged at 2.4 percent while the layoffs and discharges rate decreased to a series low of 1.0 percent.

Job Openings

“On the last business day of March, the job openings level reached a series high of 8.1 million (+597,000). The job openings series began in December 2000. The job openings rate increased to 5.3 percent.

Job openings increased in a number of industries with the largest increases in accommodation and food services (+185,000); state and local government education (+155,000); and arts, entertainment, and recreation (+81,000). The number of job openings decreased in health care and social assistance (-218,000).

The number of job openings increased in the Northeast and Midwest regions.

Hires

In March, the number and rate of hires changed little at 6.0 million and 4.2 percent, respectively. Hires increased in state and local government education (+62,000); educational services (+31,000); and mining and logging (+17,000).

The number of hires was little changed in all four regions.

Separations

Total separations includes quits, layoffs and discharges, and other separations. Quits are generally voluntary separations initiated by the employee. Therefore, the quits rate can serve as a measure of workers’ willingness or ability to leave jobs. Layoffs and discharges are involuntary separations initiated by the employer. Other separations includes separations due to retirement, death, disability, and transfers to other locations of the same firm.

In March, the number and rate of total separations were little changed at 5.3 million and 3.7 percent, respectively.

The total separations level decreased in construction (-82,000) and in state and local government education (-25,000).

Total separations were little changed in all four regions.”

More Data Later This Week

More economic data will be released later this week, including CPI data on Wednesday, Jobless Claims on Thursday and Retail Sales on Friday.