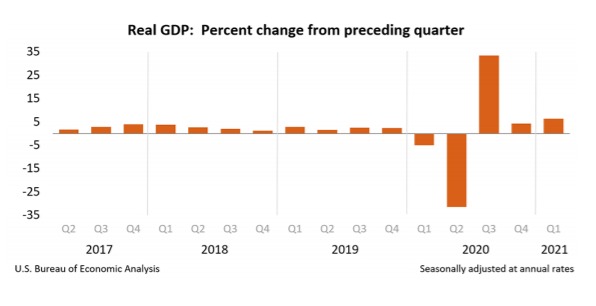

GDP Jumps 6.4% in the First Quarter

On April 29th, the Bureau of Economic Analysis reported that real gross domestic product increased at an annual rate of 6.4% in the first quarter of 2021. For perspective, in the fourth quarter of 2020, real GDP increased 4.3%.

“The increase in real GDP in the first quarter reflected increases in personal consumption expenditures (PCE), nonresidential fixed investment, federal government spending, residential fixed investment, and state and local government spending that were partly offset by decreases in private inventory investment and exports. Imports, which are a subtraction in the calculation of GDP, increased.”

But economists were quick to pounce on this disclaimer:

“The increase in first quarter GDP reflected the continued economic recovery, reopening of establishments, and continued government response related to the COVID-19 pandemic. In the first quarter, government assistance payments, such as direct economic impact payments, expanded unemployment benefits, and Paycheck Protection Program loans, were distributed to households and businesses through the Coronavirus Response and Relief Supplemental Appropriations Act and the American Rescue Plan Act.”

Further, the Bureau of Economic Analysis reported that:

- Current-dollar GDP increased 10.7 percent, or $554.2 billion, in the first quarter to a level of $22.05 trillion.

- The price index for gross domestic purchases increased 3.8 percent in the first quarter, compared with 1.7 percent in the fourth quarter.

- The PCE price index increased 3.5 percent, compared with an increase of 1.5 percent.

- Excluding food and energy prices, the PCE price index increased 2.3 percent, compared with an increase of 1.3 percent.

Personal Income Leaps in the First Quarter Too

- Current-dollar personal income increased $2.40 trillion in the first quarter, or 59.0 percent, compared with a decrease of $351.4 billion, or 6.9 percent, in the fourth quarter.

- The increase primarily reflected government social benefits related to pandemic relief programs, notably direct economic impact payments to households established by the Coronavirus Response and Relief Supplemental Appropriations Act and the American Rescue Plan Act.

- Disposable personal income increased $2.36 trillion, or 67.0 percent, in the first quarter, compared with a decrease of $402.1 billion, or 8.8 percent, in the fourth quarter.

- Real disposable personal income increased 61.3 percent, compared with a decrease of 10.1 percent.

- Personal saving was $4.12 trillion in the first quarter, compared with $2.25 trillion in the fourth.

- The personal saving rate – personal saving as a percentage of disposable personal income – was 21.0 percent in the first quarter, compared with 13.0 percent in the fourth quarter.

More Data Later This Week

More economic data will be released later this week, including Productivity and Costs data on Thursday and Consumer Credit data on Friday.