Manufacturing Sector Shows 19th Consecutive Month of Growth

The December Manufacturing ISM Report On Business was the latest indicator suggesting that the U.S. manufacturing sector (which helps drive the U.S. economy) is digging out of the deep hole created by COVID-19. But the data is also a stark reminder of the challenges we have with supply chains and rising commodity prices.

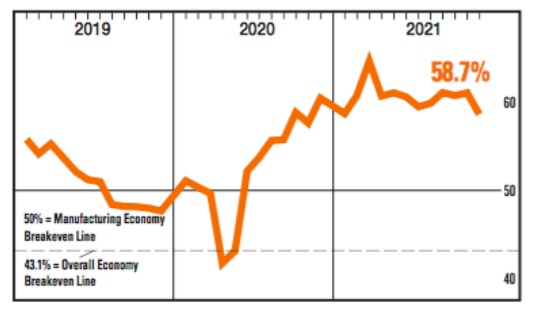

For perspective, a reading above 50 indicates expansion in the manufacturing sector. Further, the index bottomed out at a reading of around 41 in April 2020, when economic lockdowns were implemented, and the last few months have shown readings in the high 50s and low 60s

Released on Tuesday, January 4th, “Economic activity in the manufacturing sector grew in December, with the overall economy achieving a 19th consecutive month of growth.”

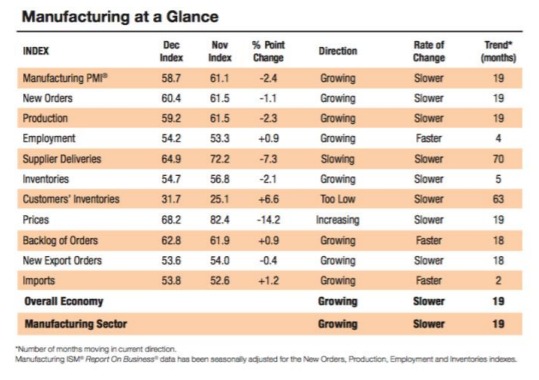

“The December Manufacturing PMI® registered 58.7 percent. The New Orders Index registered 60.4 percent,

down 1.1 percentage points compared to the November reading of 61.5 percent.

The Production Index registered 59.2 percent, a decrease of 2.3 percentage points compared to the November reading of 61.5 percent. The Prices Index registered 68.2 percent, down 14.2 percentage points compared to the November figure of 82.4 percent. The Backlog of Orders Index registered 62.8 percent, 0.9 percentage point higher than the November reading of 61.9 percent.

The 15 manufacturing industries reporting growth in December — in the following order — are: Apparel, Leather & Allied Products; Furniture & Related Products; Textile Mills; Plastics & Rubber Products; Machinery; Nonmetallic Mineral Products; Miscellaneous Manufacturing; Chemical Products; Electrical Equipment, Appliances & Components; Fabricated Metal Products; Computer & Electronic Products; Food, Beverage & Tobacco Products; Transportation Equipment; Primary Metals; and Petroleum & Coal Products. The three industries reporting a decrease in December compared to November are: Wood Products; Printing & Related Support Activities; and Paper Products.

All of the six biggest manufacturing industries — Chemical Products; Fabricated Metal Products; Computer & Electronic Products; Food, Beverage & Tobacco Products; Transportation Equipment; and Petroleum & Coal Products, in that order — registered moderate-to-strong growth in December.”

More Data Later This Week

More economic data will be released later this week, including Motor Vehicle Sales on Wednesday; Factory Orders on Thursday; and the Employment Situation Report on Friday.

Click here to download a PDF of this report.

Weekly Market Recap

The week in review

- Nonfarm payrolls: +199K

- JOLTS job openings: +10,562K

- Light vehicle sales: 12.4M