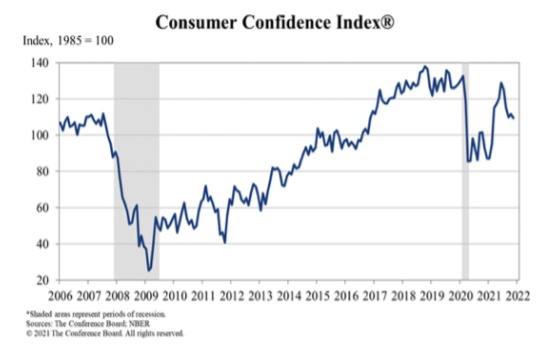

Consumer Confidence Waning

Understanding Consumer Confidence

The Conference Board was founded in 1916 by a group of CEOs “concerned about the impact of workplace issues on business, and with a desire for greater cooperation and knowledge sharing among businesses.”

Every month, the Conference Board, in conjunction with Nielsen, compiles a survey of consumer attitudes on the economy in order to create its Consumer Confidence Index, which captures “consumers’ perceptions of current business and employment conditions, as well as their expectations for six months hence regarding business conditions, employment, and income.”

Consumer Confidence Slips in November

From the release dated November 30th, the Consumer Confidence Index decreased in November, after an increase in October. The Index now stands at 109.5 (1985=100), down from 111.6 in October.

Present Situation

“Consumers’ appraisal of current business conditions was less favorable in November.

- 17.0% of consumers said business conditions are “good,” down from 18.3%.

- 29.0% of consumers said business conditions are “bad,” up from 25.7%.

Consumers’ assessment of the labor market was moderately more favorable.

- 58.0% of consumers said jobs are “plentiful,” up from 54.8%.

- Conversely, 11.1% of consumers said jobs are “hard to get,” virtually unchanged from 11.0%.

Expectations Six Months Hence

Consumers’ optimism about the short-term business conditions outlook increased in November.

- 24.1% of consumers expect business conditions will improve, up from 22.7%.

- 20.7% expect business conditions to worsen, down from 21.9%.

Consumers were less optimistic about the short-term labor market outlook.

- 22.1% of consumers expect more jobs to be available in the months ahead, down from 24.4%.

- 18.9% anticipate fewer jobs, up slightly from 18.7%.

Consumers were less positive about their shortterm financial prospects.

- 17.9% of consumers expect their incomes to increase, down from 18.4%.

- 12.0% expect their incomes will decrease, up from 11.2%.”

More Data Later This Week

More economic data will be released later this week, including Constructions Spending on Wednesday, Motor Vehicle Sales on Thursday and Factory Orders on Friday.