Investors learning how to invest in the stock market might ask when to invest. Knowing when to invest, however, isn’t as important as how long you stay invested.

Riding it out

Trying to navigate the peaks and valleys of market returns, investors seem to naturally want to jump in at the lows and cash out at the highs. But no one can predict when those will occur. Of course we’d all like to avoid declines. The anxiety that keeps investors on the sidelines may save them that pain, but it may ensure they’ll miss the gain. Historically, each downturn has been followed by an eventual upswing, although there is no guarantee that will always happen.

Riding it out

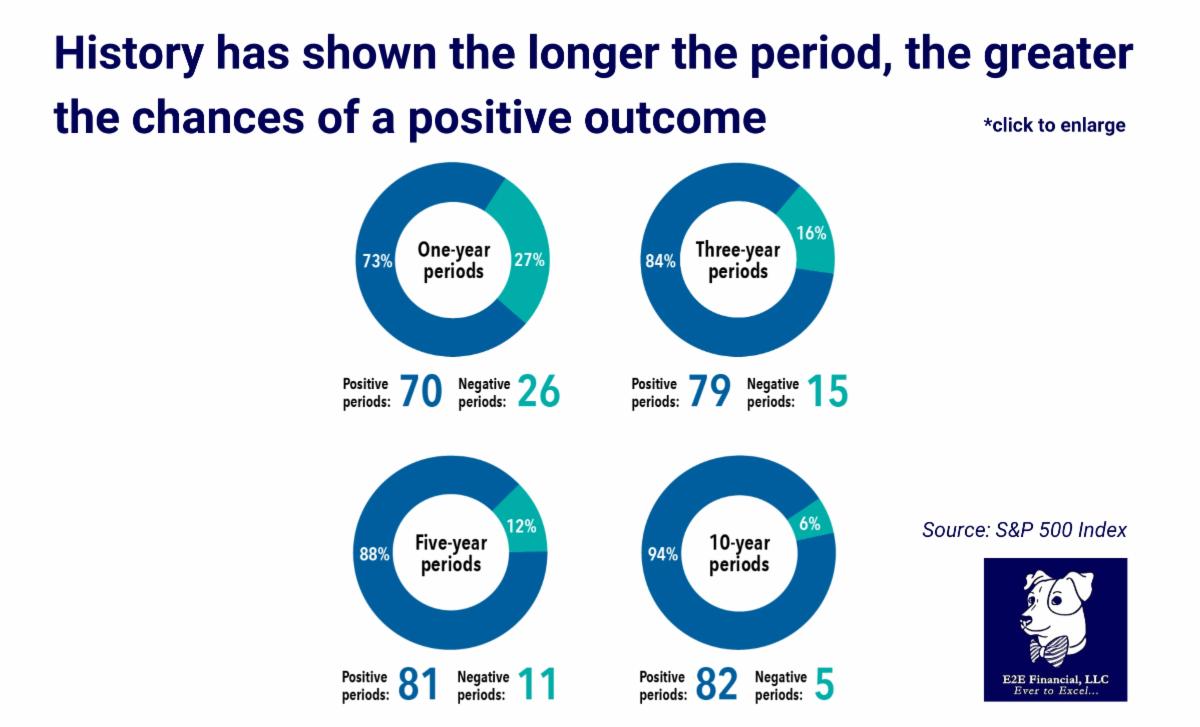

Over the past 96 years, the S&P 500 has gone up and down each year. In fact, 27% of those years had negative results. As you can see in the chart below, one-year investments produced negative results more often than investments held for longer periods. If those short-term one-year investors had held on for just two more years, they would have experienced nearly half as many negative periods.

And the longer the time frame — through highs and lows — the greater the chances of a positive outcome. Indeed, over the past 96 years, through December 31, 2023, 94% of 10-year periods have been positive ones. Investors who have stayed in the market through occasional (and inevitable) periods of declining stock prices historically have been rewarded for their long-term outlook.

Rather than trying to predict highs and lows, it’s important to stay invested through a full market cycle. Focus on the time you stay invested, not the timing of your investments.

Do you have a financial coach that helps you through volatile markets? Your best action may be no action at all! Might be time for a second opinion. Reach out and schedule your free volatility analysis.

Read more here.

And as always, your weekly market update.