In a year when soaring inflation, the war in Ukraine and a bear market have commanded headlines, the U.S. midterm elections risked becoming an afterthought. But now the election is coming back into focus. And with good reason. Capital Group political economist Matt Miller believes 2022 could be one of the more consequential midterm elections in U.S. history.

But while control of Congress may be at stake, do midterm elections have any effect on equity markets?

Midterm elections occur at the midpoint of a presidential term and usually result in the president’s party losing ground in Congress. Over the past 22 midterm elections, the president’s party has lost an average 28 seats in the House of Representatives and four in the Senate. Only twice has the president’s party gained seats in both chambers.

It may come as no surprise then that market volatility is higher in midterm election years, especially in the weeks leading up to Election Day. Since 1970, midterm years have a median standard deviation (a measurement of volatility) of returns of nearly 16%, compared with 13% in all other years.

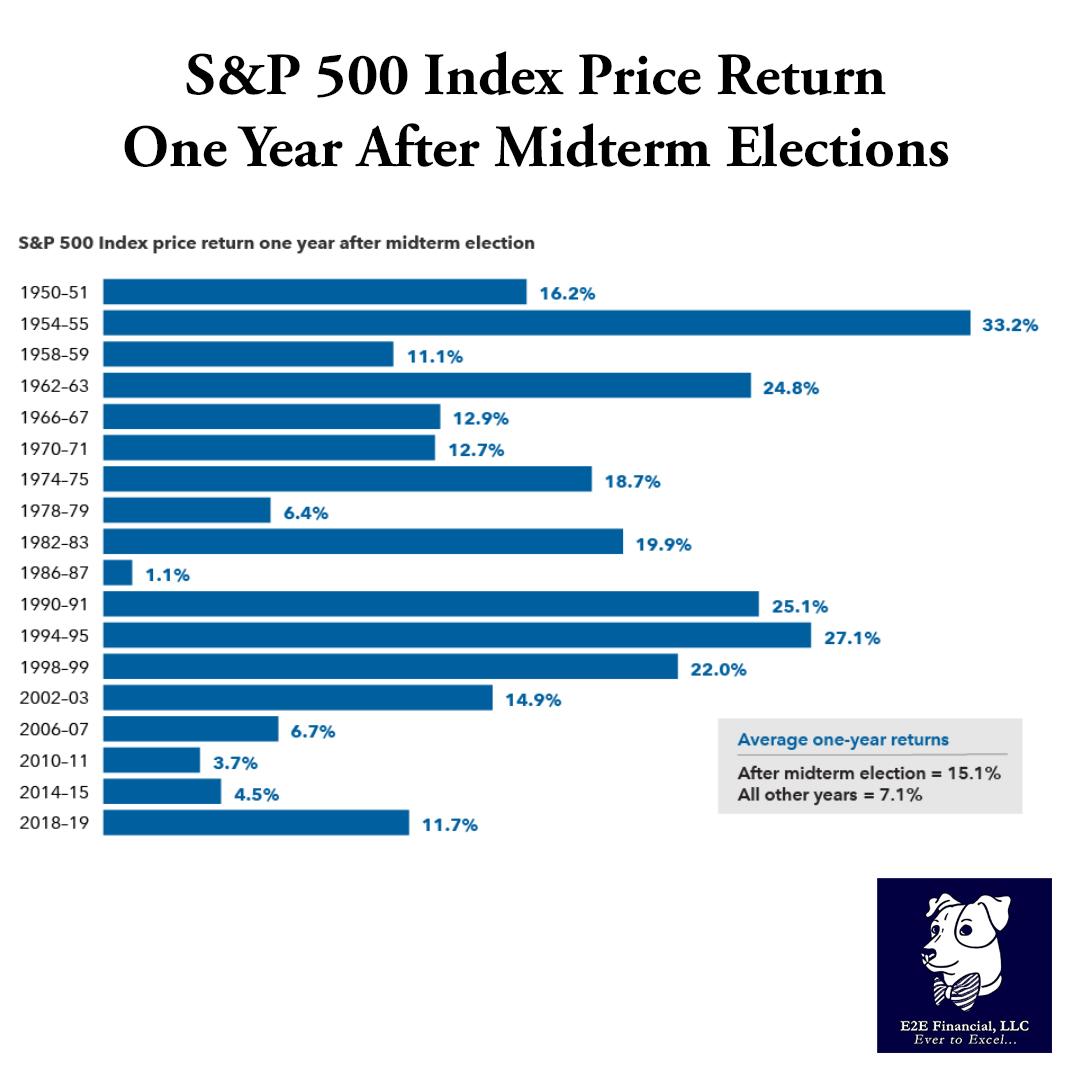

The silver lining for investors is that markets have tended to rebound strongly in subsequent months, and the rally that has often started shortly before Election Day hasn’t been just a short-term blip. Above-average returns have been typical for the full year following the election cycle. Since 1950, the average one-year return following a midterm election was 15%. That’s more than twice the return of all other years during a similar period. (see the chart)

Of course every cycle is different, and elections are just one of many factors influencing market returns. For example, over the next year investors will need to weigh the impacts of a potential U.S. recession and global economic and geopolitical concerns.

What’s the bottom line for investors?

Midterm elections — and politics as a whole — generate a lot of noise and uncertainty.

Even if elections spur higher volatility there is no need to fear them. The reality is that long-term equity returns come from the value of individual companies over time. Smart investors would be wise to look past the short-term highs and lows and maintain a long-term focus. Need help on reviewing you long term investing? Reach out to schedule your free review meeting .

Here is this week’s market update.

Source: Capital Ideas