Some insight this week from our partners at JP Morgan…

“With a still-tight labor market and expectations for rising real income in the coming months, it’s not clear the economy is headed towards recession just yet.

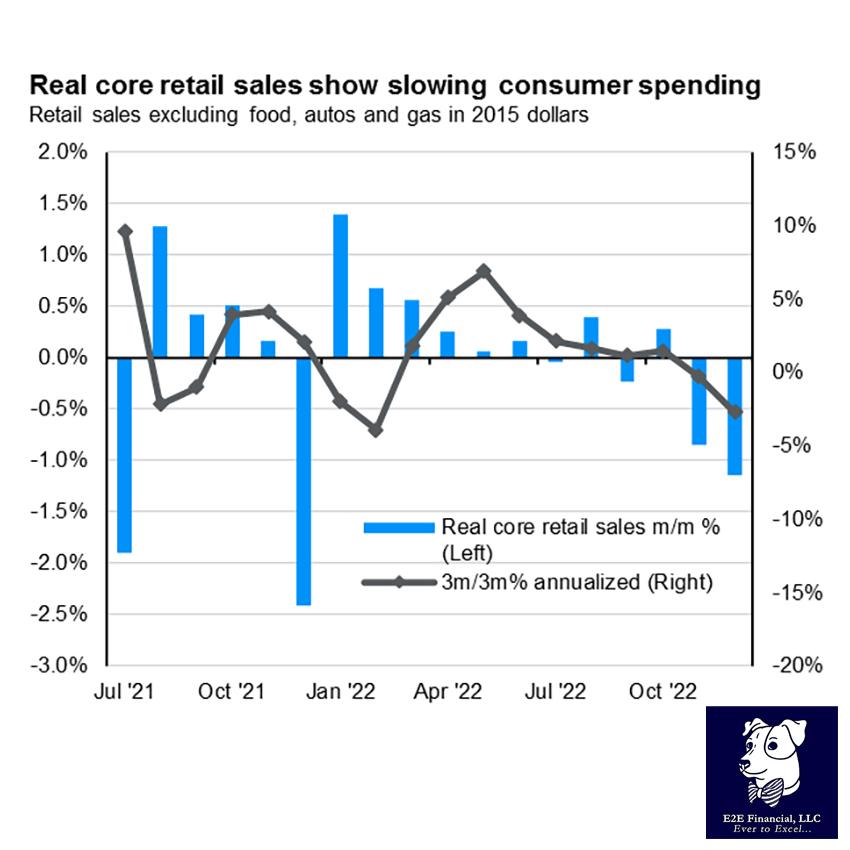

While markets have been fairly resilient at the start of the year, recent economic data have pointed to further weakening in the economy. Overall and core retail sales (excluding autos, gas and food) fell sharply in December, and while poor weather conditions may be partly to blame, the data suggest consumers were much more reserved in their spending during the holiday season. Other indicators, such as manufacturing PMIs, industrial production and regional Fed surveys, also showed declining momentum in December. With back-to-back declines in both nominal and real core retail sales, there is a clear softening in the underlying trend for consumers, as shown in the chart. This is important because consumption represents the lion’s share of the U.S. economy, suggesting economic growth may be on tough footing as we start the year after our estimate of slightly over 2% annualized growth in the fourth quarter.

However, a boost to Social Security payments associated with the annual cost of living adjustment in January should meaningfully lift incomes and spending. Moreover, with an inflation downdrift firmly underway, consumers should see a welcome boost in their real personal income in 2023. Real-time data on the labor market also point to continued resilience, with initial jobless claims surprising to the downside this week and continuing jobless claims only modestly grinding higher. With a still-tight labor market and expectations for rising real income in the coming months, it’s not clear the economy is headed toward recession just yet.”

Not sure how to invest your portfolio or need a second opinion? Reach out to schedule your free consultation.

Your weekly market update is here.