It’s been a tough year for investment markets. The S&P 500 is down -21.61% year to date. You wouldn’t be human if you didn’t fear loss.

Nobel Prize-winning psychologist Daniel Kahneman demonstrated this with his loss aversion theory, showing that people feel the pain of losing money more than they enjoy gains. The natural instinct is to flee the market when it starts to plummet, just as greed prompts people to jump back in when stocks are skyrocketing. Both can have negative impacts.

But smart investing can overcome the power of emotion by focusing on relevant research, solid data and proven strategies. There are seven principles that can help fight the urge to make emotional decisions in times of market turmoil. Here is one of them….

Time in the market matters, not market timing

No one can accurately predict short-term market moves, and investors who sit on the sidelines risk losing out on periods of meaningful price appreciation that follow downturns.

Every S&P 500 decline of 15% or more, from 1929 through 2020, has been followed by a recovery. The average return in the first year after each of these declines was 55%.

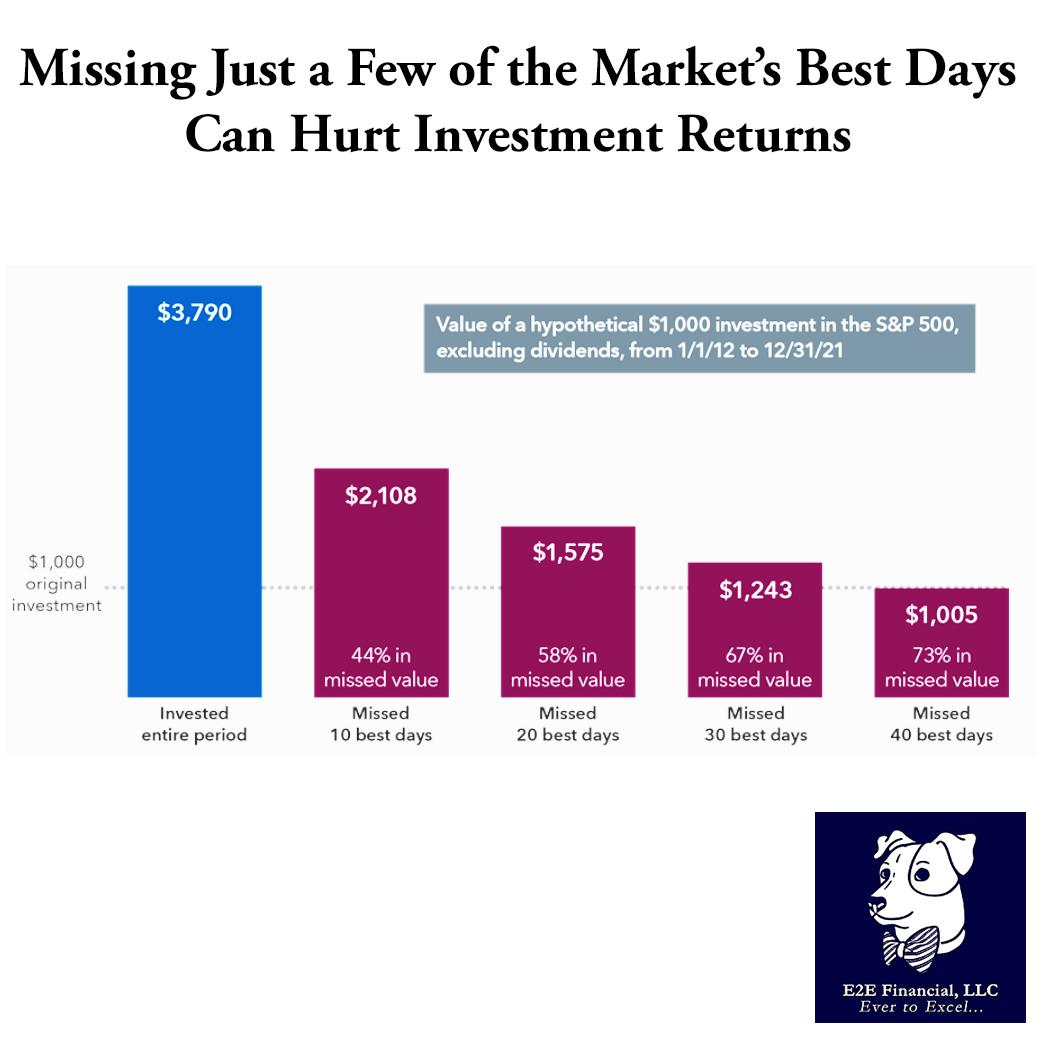

Even missing out on just a few trading days can take a toll. A hypothetical investment of $1,000 in the S&P 500 made in 2012 would have grown to more than $3,790 by the end of 2021. But if an investor missed just the 10 best trading days during that period, he or she would have ended up with 44% less.

Want help on weathering the investment ups and downs? Reach out and set up your free investment portfolio review.

Your weekly market update is here .