This week we’re taking a deeper look at tariffs (as of today!) and the impact of the economy. Steve Watson Equity Portfolio Manager with the Capital Group (home of the American Funds) takes a look….

The latest round of tariffs launched by the U.S. government in early April prompted a wave of criticism from world leaders, including some who say globalization is now dead. As a global investor for over four decades, I respectfully disagree. Globalization isn’t dead. It is, however, changing in a significant way.

The damage spilled over to the U.S. Treasury market, which may explain why Trump paused some tariffs. The yield on the 10-year Treasury, a cornerstone of the global financial system, widened to 4.34% from 4.01% a few days prior — an indication of market turbulence.

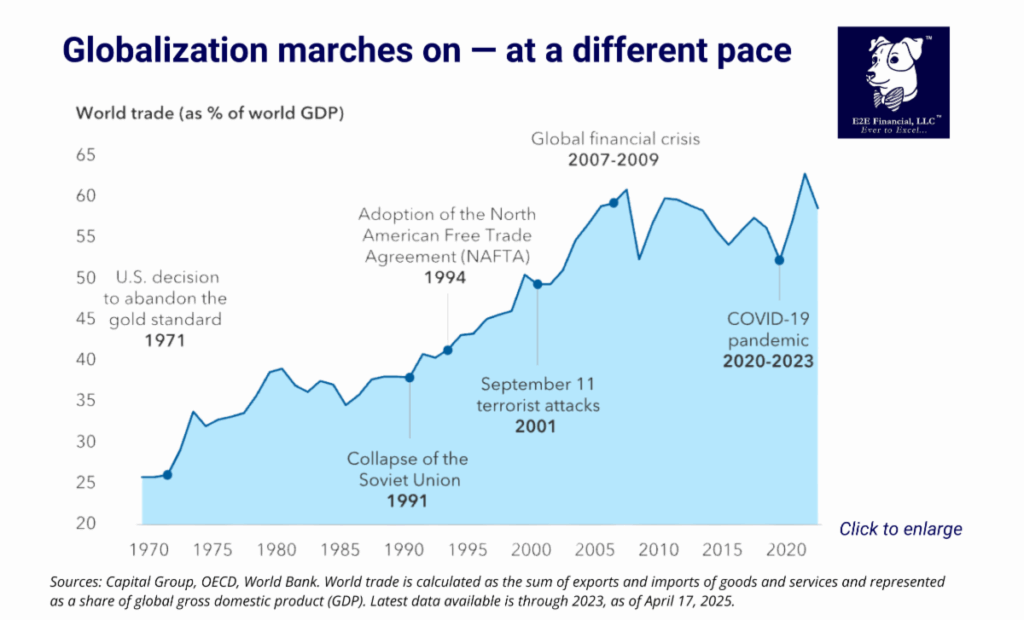

Could it take a step back? Yes, I think it will. There are valid reasons for globalization to go through a policy refresh — at least, the type of globalization that we’ve become accustomed to since the early 1970s when trade expansion started a meteoric rise. In fact, the tectonic plates of world trade have been shifting for some time. Today’s changes feel seismic, but trade as a percent of world GDP has moved roughly sideways since the global financial crisis between 2007 and 2009.

A decade later the COVID-19 pandemic revealed some of the problems associated with globalization, as did the Russia-Ukraine war. Both events exposed the vulnerabilities of global supply chains that rely too heavily on single trade routes. Since then, we have learned important lessons. Countries and companies have sought to diversify supply chains and bring some manufacturing back home, or closer to home, so everyone can get what they need to keep their economies thriving. Read more here.

Is your investment plan updated to the current world? Take action! Get your free second opinion with us. Click here to schedule.

Plus, your weekly market update.