This week, some thoughts from our partners at JP Morgan…..

Inflation is often feared to be a self-fulfilling prophecy, as consumers and businesses that expect higher prices may inadvertently fuel inflationary pressures themselves. For example, consumers may ask for a raise or accelerate purchases to front-run rising prices, while businesses may hike prices in anticipation of higher input costs. To maintain price stability, the Federal Reserve closely monitors long-term inflation expectations and aims to keep them anchored at levels consistent with its inflation mandate. For investors, understanding the different measures of inflation expectations is critical for assessing the outlook for inflation and policy.

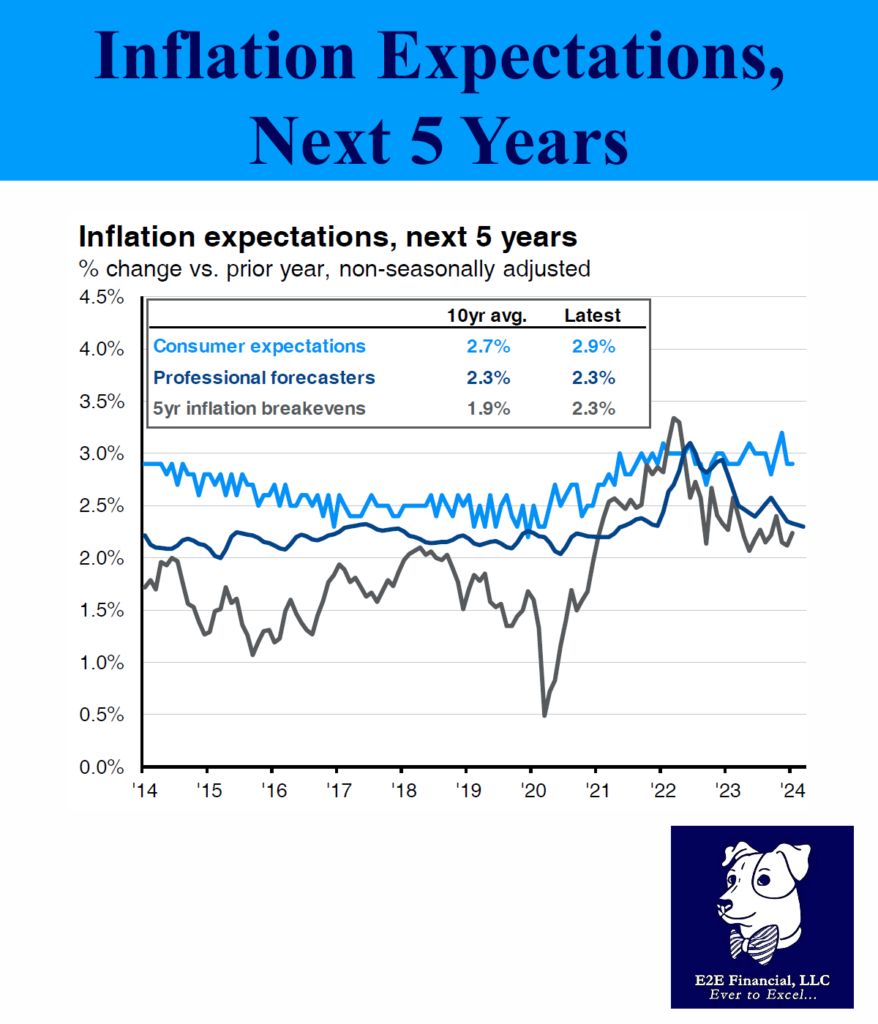

This week’s chart tracks inflation expectations for the next five years from consumers, professional forecasters and financial markets. After spiking in 2022, inflation expectations have steadily trended back to normal. In fact, professional forecasters surveyed by the Philadelphia Fed and investors trading 5-year breakevens both expect annual CPI inflation of 2.3%, consistent with the Fed reaching and maintaining its 2% PCE inflation target through 2028. Consumers, likely burdened by negative headlines, have a more pessimistic outlook, as those surveyed by the University of Michigan anticipate annual inflation of 2.9%. However, not only have consumers’ expectations historically settled above others, but also they move more slowly and rarely deviate from their long-term average, suggesting that financial markets and professionals may offer more valuable insights in real time.

Despite geopolitical tensions and resilient economic activity, well-anchored inflation expectations should help keep inflation on its downward trend, opening the door for policy easing from the Fed later this year. Indeed, the January CPI report could show that the disinflationary momentum established in 2023 continued into 2024.

Stock markets are strong, and the economy is trending well. How can we help you make sure your investments keep pace? Reach out and set up a time to chat with us.

Your weekly market update is here.