The latest consumer price index (CPI) report released Wednesday, May 11, has confirmed that the U.S. Federal Reserve has a long way yet to go in its fight against inflation. Core inflation — all items except food and energy — rose 6.2% year over year in April, keeping it at a level not seen in nearly 40 years.

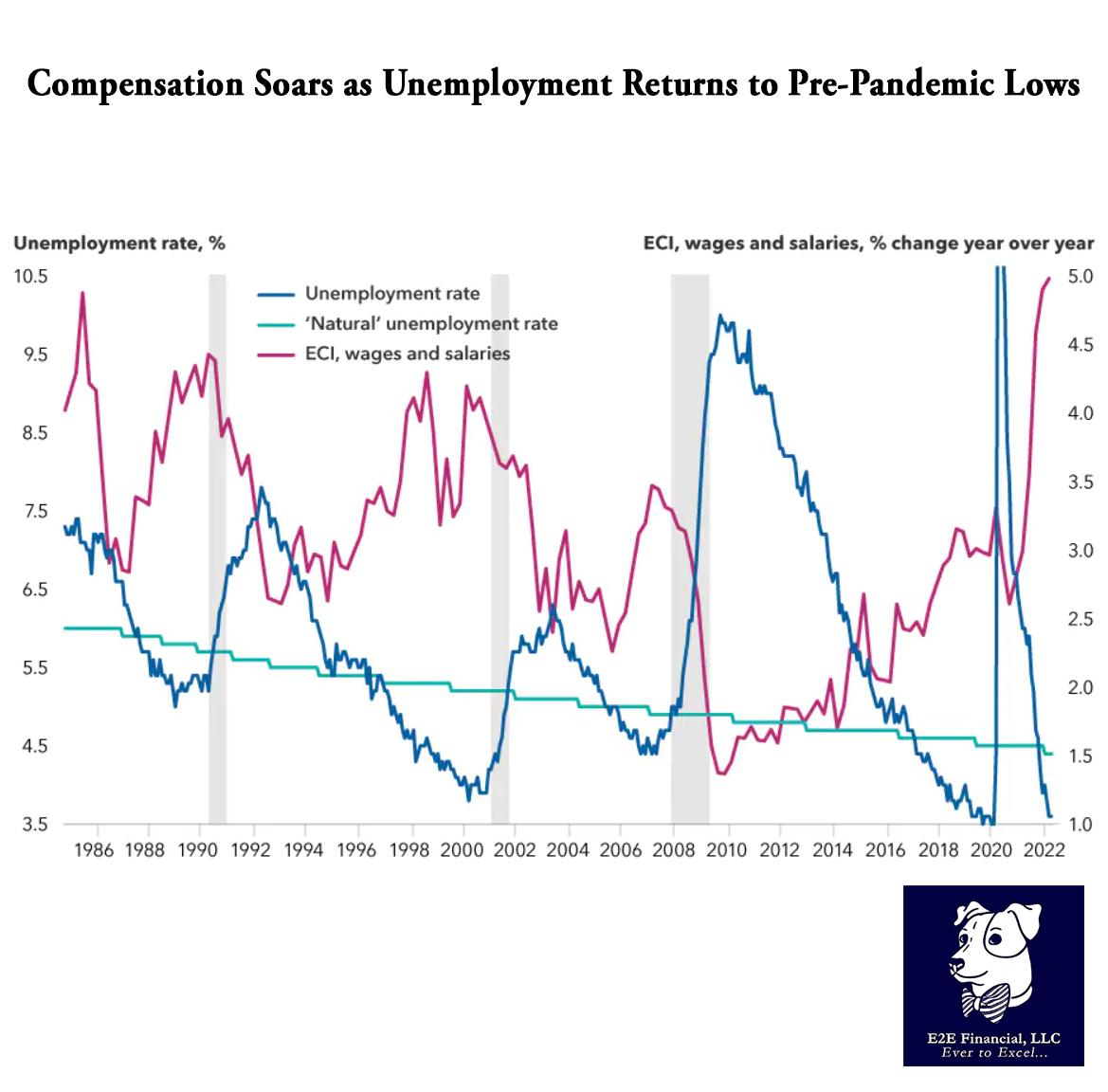

Much of this is, no doubt, created by supply shocks, which fall outside the central bank’s area of control, as Fed Chair Jerome Powell pointed out in his May press conference. The Fed can, however, affect demand in the historically tight labor market. Its plan to continue implementing 50 basis point (bps) rate hikes should introduce some slack — but the question is, how far will it have to go to achieve its goal on inflation? We are starting to see a moderate wage-price spiral developing in the United States.

Workers are getting the higher compensation they are asking for because the labor market is extremely tight. Many workers who went missing during the pandemic have not come back. Today’s unemployment rate is similar to before the pandemic, but the labor force participation rate still lags. It was 62.2% in April 2022, compared to 63.4% in February 2020, according to the Bureau of Labor Statistics (BLS). Employers also reported a record 11.5 million open jobs in March 2022, according to BLS data.

The natural unemployment rate, which represents unemployment not linked to cyclical demand, has declined over time, but is still likely a full percent above the current unemployment rate, and perhaps higher.

Many of you are seeing these wage increases as an employee and employer. Are you planning accordingly for your financial future? Reach out to schedule your complementary financial review to see if you are on track.

Your weekly market update is here.

Source: Capital Ideas