The resilience of the U.S. is amazing. Despite all the turmoil in the world, the U.S. economy somehow manages to look past it, power through it, and come out stronger on the other side. Here’s what Capital Group economist Jared Franz has to say:

The resilience of the U.S. is amazing. Despite all the turmoil in the world, the U.S. economy somehow manages to look past it, power through it, and come out stronger on the other side. Here’s what Capital Group economist Jared Franz has to say:

“There is a lively debate among economists these days over whether U.S. economic growth could accelerate to 5% this year. That’s a number we haven’t seen on a sustained, multiyear basis since the 1960s and 1970s. Over the last two decades, U.S. gross domestic product (GDP) growth has generally been less than half that amount — averaging roughly 2.1%.

What needs to happen to return to the days of 5% growth? A lot. But based on my analysis, it is within the realm of possibility. And we really aren’t that far off, given that the most recent GDP print (3Q 2025) came in last week at 4.4% annualized.

1. Don’t discount election year politics

The first consideration is that 2026 is an election year. The U.S. midterm elections are just 10 months away, and President Trump has made it clear he wants to run the economy hot as we head toward November. That means bringing interest rates down, wages up, boosting the labor market, and using government stimulus measures to put money directly in the hands of American consumers.

2. Stimulus measures should boost consumption

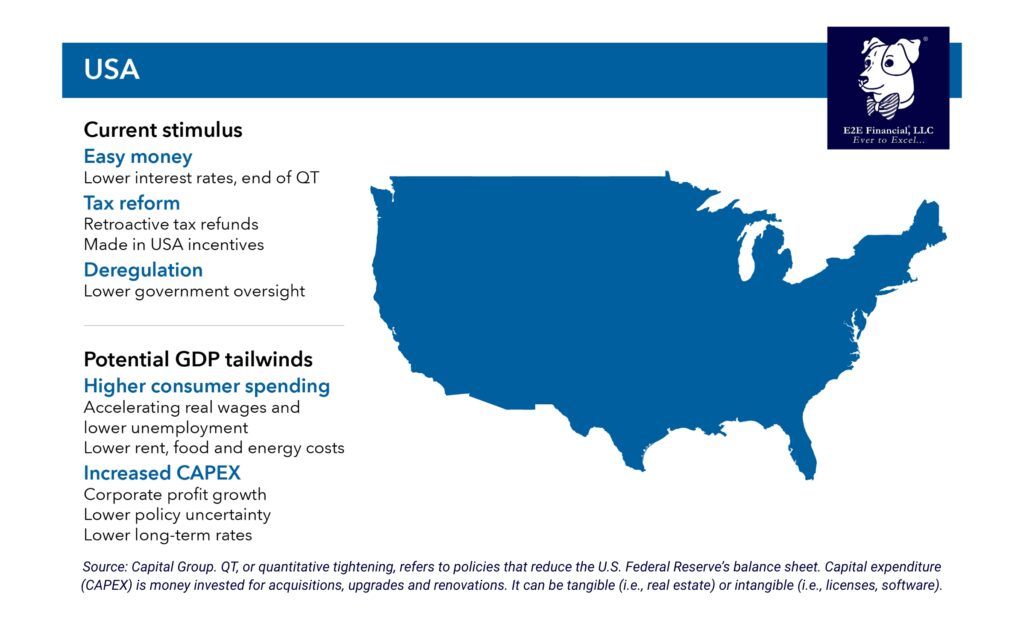

Numerous government stimulus measures are already in place — from tax cuts included in the One Big Beautiful Bill Act, to retroactive tax refunds, to massive tax breaks and subsidies for companies that agree to move their manufacturing operations to the United States. More recently, the president has championed the idea of “tariff dividends” for U.S. citizens under certain income thresholds, though such a move typically requires an act of Congress.

3. AI-powered productivity boost

Finally, we need to see a rebound on the industrial side of the U.S. economy, which has been stagnant for the past three years. That’s an unusually long recession for U.S. industrial activity and, in my view, it isn’t likely to continue much longer. We are already seeing evidence of increasing inventory investments as the global economy, along with the U.S. economy, picks up speed.

While I think 5% GDP growth is possible this year, there are also many risks associated with such an optimistic forecast. In the stock market, we would call that “priced for perfection.” It leaves no room for disruption from trade disputes, geopolitical conflicts, labor market weakness, social unrest or market turbulence that could result from one or more of those events.”

Click here to read the full article from the Capital Group.

It’s important to feel confident about your future. Get a second look at your portfolio by scheduling a complimentary consultation with us.

And as always, your weekly market update is here.