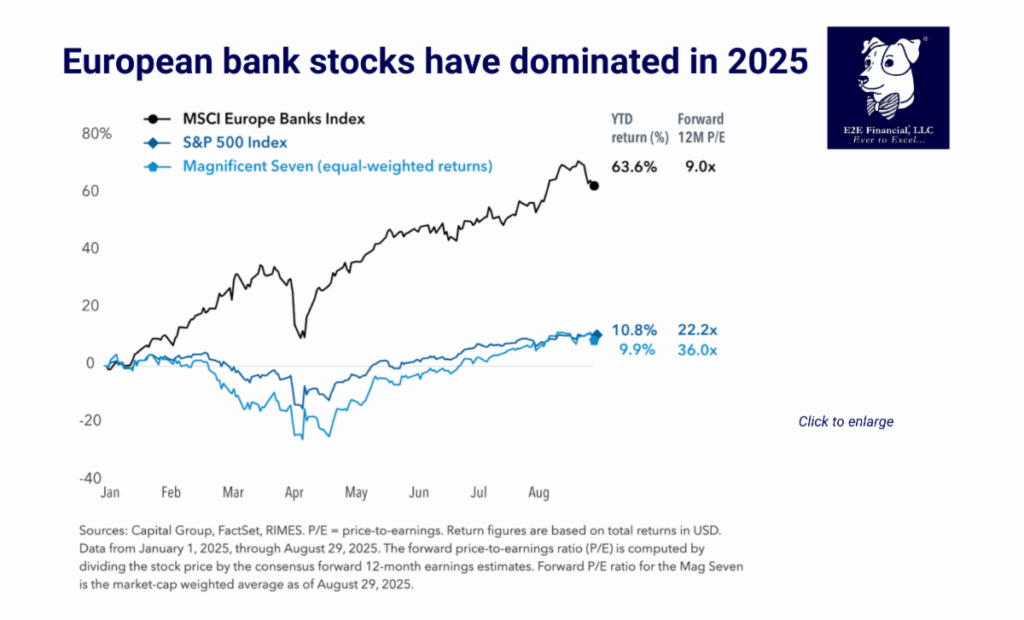

If you were hunting for a group of stocks to dethrone the Magnificent Seven (“Mag Seven”), there’s a good chance European banks weren’t at the top of your list. But looking at returns over the past 12 months and on a year-to-date basis, that’s exactly what happened.

European banks have had a stellar run, significantly outpacing the Mag Seven group of U.S. technology leaders and the S&P 500 Index. The MSCI Europe Banks Index has returned 63.6% through August, on track for its best calendar year since 1997. By comparison, the Mag Seven returned 9.9%.

The rise of European banks comes amid a broader rally for international stocks, helped by large-scale German stimulus, a weakened U.S. dollar and concerns about the outsized positions held by certain U.S. technology stocks in global market indices.

Hear from Samir Parekh: equity portfolio manager for Capital Group, on his five reasons European banks are back in favor and why he believes they continue to look attractive:

1. A normal interest rate environment

Banks have endured eight years of negative interest rates from the European Central Bank (ECB). The policy changed in July 2022, and it’s helped boost net interest income. Rates rose to 4% before the ECB began to loosen monetary policy this year.

2. Regulatory burdens have eased

Banks amassed significant capital reserves in the wake of the sovereign debt crisis, and regulators have lowered certain threshold requirements. One outcome has been growing dividend payouts.

3. Loan growth is picking up

We are starting to see signs of loan growth, something virtually unheard of since the 2010 European sovereign debt crisis that triggered financial bailouts for several countries.

4. Tariff risks are low

In contrast to the automotive sector, many European banks are domestically focused, conducting their operations primarily at the country level. They are not trading physical goods from one country to another.

5. Valuations are reasonable

Despite the rally, European banks trade at reasonable valuations given what is expected to be a reacceleration of economic growth across Europe. Earnings estimates for 2025 and 2026 have also increased.

The remarkable run of European banks is a good reminder to consider a globally diversified portfolio and maintain a long-term perspective. Read more here.

Time for a second opinion on your portfolio? Reach out for your complimentary review.

Plus, your weekly market update is here.