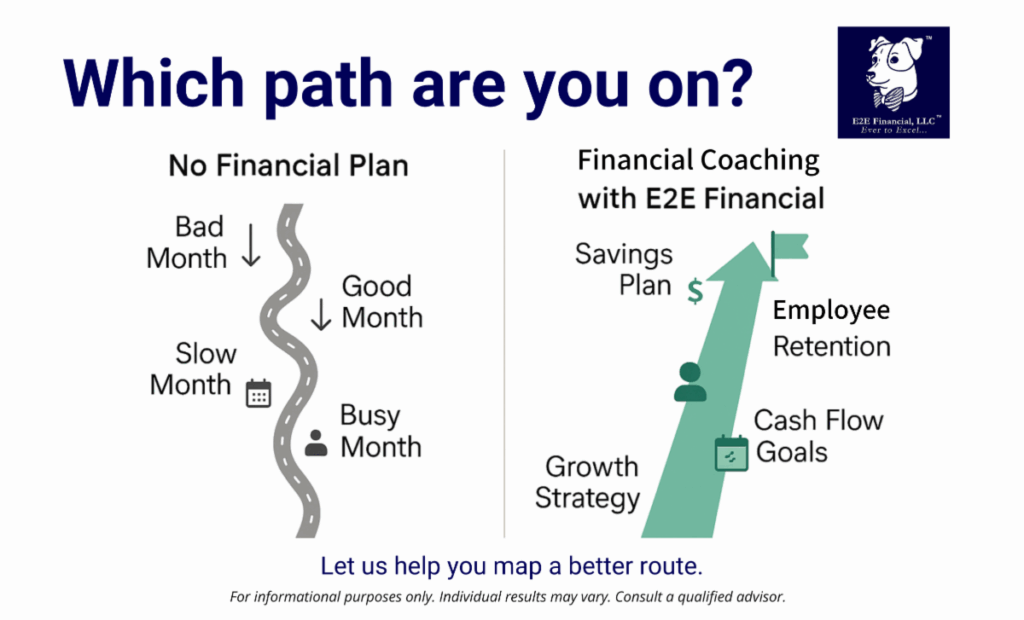

Are you sick of not having consistent month to month collections and the cash flow to pursue your financial goals? You’re not alone. One month you’re hitting collection goals and feeling unstoppable and the next, you’re wondering what happened.

Are you sick of not having consistent month to month collections and the cash flow to pursue your financial goals? You’re not alone. One month you’re hitting collection goals and feeling unstoppable and the next, you’re wondering what happened.

At E2E Financial, we work with dentists who are ready to break that cycle. It’s not about working harder, feeling like you need to add more new patients, or adding more and more clinical skills. It’s starts with discovering your financial goals and then focusing on your financial engine that drives your success: your practice!!!

Here are a few ways top dentists build more predictable success:

1. Create a Personal Financial Plan

It’s easy to blur the line between your practice finances and your personal finances. Create a simple plan for your personal financial goals that includes savings, debt planning, and investing goals. (Need help? Our team offers complimentary financial snapshots.)

2. Review, access and update your practices’ fundamentals

Your dental practice(s) is the engine behind your financial future. Review the fundamentals including: hiring/onboarding/training staff, morning huddles, knowing your current patients and their dental health needs. When you focus on the practice fundamentals and improving them, everything works more smoothly.

3. The Main Thing is to Keep The Main Thing The Main Thing

Your time is your most valuable asset. We help you identify the areas of your practice that drive your personal financial goals, so your daily efforts focusing on collections and profits (“The main thing”) move you closer to long-term stability and freedom.

Consistency doesn’t come from luck. It comes from having a real plan in place.

The good news? With over 20 years of experience in financial coaching for dentists, we know the building blocks of a strong, efficient practice. If you’re ready to build a plan for your goals (or want a second opinion), we’d love to help you get started. Schedule your complimentary consultation with us today.

If we discover that you need assistance in specific areas of your practice(s), we can refer you to experienced dental consultants who can help