With talk of tariffs and trade wars commanding front-page headlines all week, it’s important for investors to pause, take a breath and evaluate the events through a long-term lens. What are the actual, lasting impacts of tariffs on the United States and other countries? Will they outweigh other factors driving the growth of the world’s largest economy? And what happens next?

From Capital Group’s economist, Jared Franz….

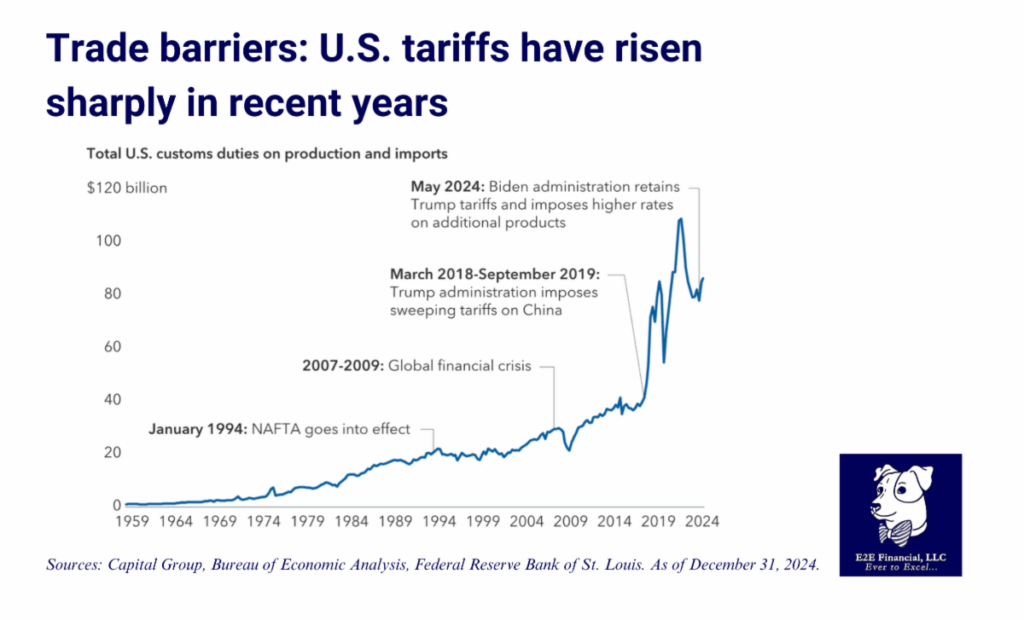

“Tariff announcements over the past few days, and the subsequent agreements to delay them, do not change my overall positive view on the outlook for the U.S. economy. Higher tariffs have been part of my base case for quite a while, even before U.S. President Donald Trump’s election victory in November. Trade barriers have been rising since the end of the global financial crisis in 2009, with sharp increases under both Trump and President Biden. So the writing has been on the wall for several years.

The initial tariffs aimed at Canada and Mexico this week were higher than I had expected, but those have been delayed for at least a month and may be decreased or even disappear. Conversely, the tariffs aimed at China are lower than I had anticipated. It’s still not clear what the final effective tariff rates will be, to which goods they will apply, and when or if they will be implemented. In my view, Trump is more concerned with reaction from the U.S. stock market than he is the bond market. That may rein in his inclination to impose crippling trade barriers for extended periods of time.

With this in mind, I stand by my optimistic assessment. I expect the U.S. economy to continue on a path toward healthy expansion in 2025, roughly in the range of 3% GDP growth. As I explained late last year, I believe the U.S. business cycle is aging in reverse, transitioning from a late-cycle to a mid-cycle path, characterized by rising corporate profits, accelerating credit demand and generally neutral monetary policy. Most important, I do not see a recession on the horizon.

All the tariff talk this week changes nothing in that positive assessment.”

Time for a second opinion? Reach out for your free consultation.

And, as always, your weekly market update is here.