Capital Group, home of the American Funds, has put out a great article regarding artificial intelligence (AI) and the impact on investing. We highly recommend you invest the time to read the full article.

The highlights…..

Artificial intelligence (AI) is having an iPhone moment with the launch of ChatGPT, a chatbot technology that can simulate human-like understanding and produce well-crafted, conversational responses.

Racing to a million users in five days — and 100 million by January 2023 — ChatGPT has already been used to write short stories and academic papers as well as to create music and videos. Since the release of the chatbot, developed by OpenAI with a more than $10 billion investment from Microsoft, every day seems to bring news of incremental advances in natural language models, along with occasional apocalyptic warnings about the rise of robot overlords.

For starters, ChatGPT does not yet possess human logic per se, but can be better thought of as hyper-scale pattern recognition. Such chatbots built on large language models are one example of how AI is already being applied across the economy. The key question for investors is: Has AI finally reached a commercial tipping point?

Capital Group equity managers share their views on how artificial intelligence is transforming industries and driving opportunity for companies and investors.

1. Robots are already here — and getting smarter

As interesting as large language models like ChatGPT are, it is possible AI-powered robots will have a bigger economic impact in the next handful of years.

2. AI in health care is helping doctors make better diagnoses

Often we think about innovation within health care in terms of drug discovery. But tech and health care are coming together in interesting ways. AI is playing a growing role in helping medical professionals generate new treatments and better patient outcomes.

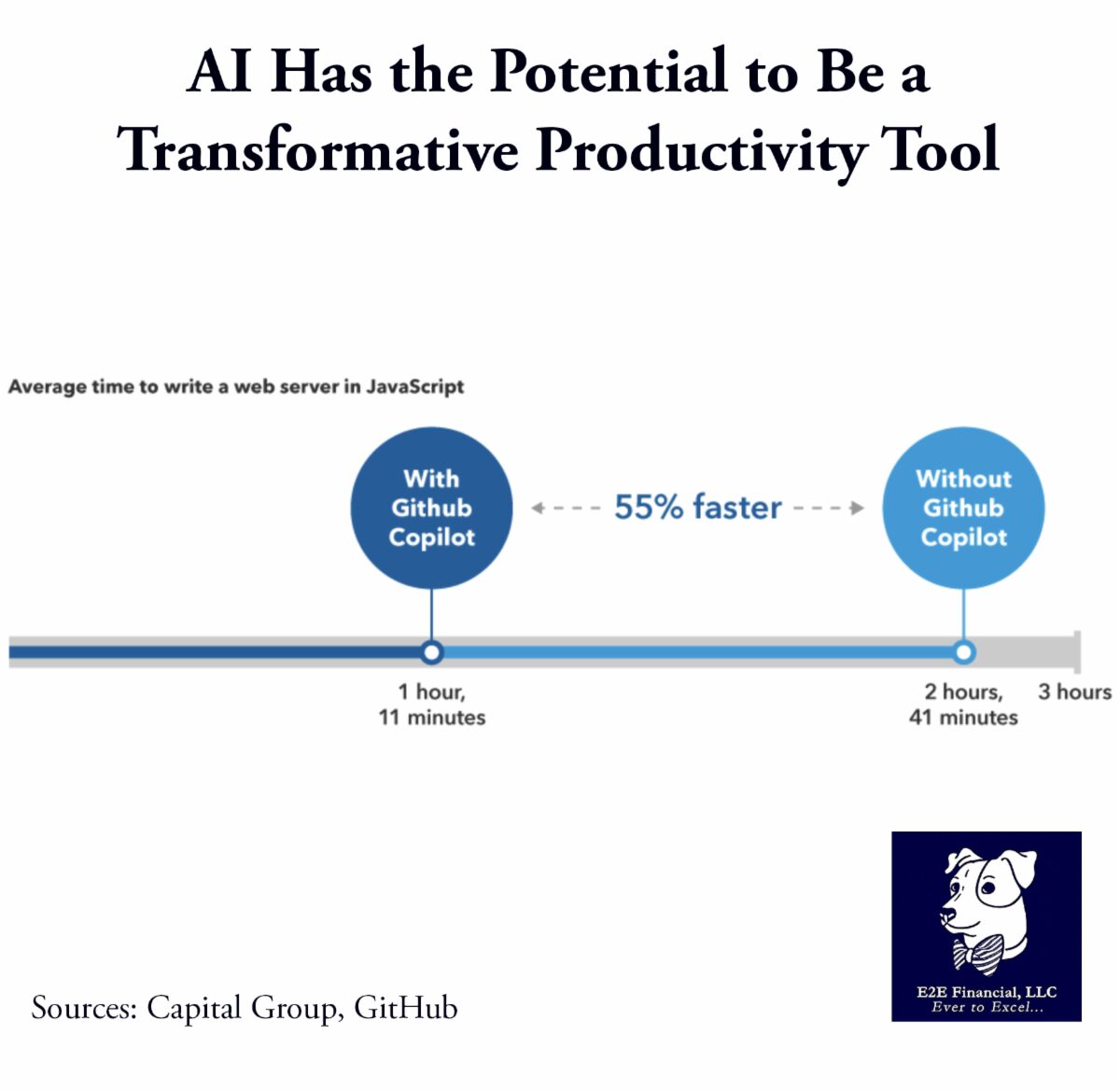

3. AI can drive productivity and disruption across industries

One of the most striking developments has been the pace of progress in the AI ecosystem since the release of ChatGPT. As with prior tech platforms, the tipping point often comes when a broad base of developers starts building useful tools on top of the underlying technology.

We, at E2E, work with top fund companies to stay on top of cutting edge investment opportunities. It all fits in to a model portfolio to fit your risk tolerance and goals. Be sure to review your current portfolio. We offer a free second opinion service. You can schedule your meeting here.