Sources: Capital Group, Bloomberg Index Services, Ltd., Morningstar, Standard & Poor’s. All returns are inflation-adjusted real returns. US equity returns represented by the S&P 500 Composite Index. US fixed income represented by Ibbotson Associates SBBI US Intermediate-Term Government Bond Index from 1/1/1970 to 12/12/1975 and Bloomberg US Aggregate Bond Index from 1/1/1976 to 12/31/2020. Inflation rates are defined by the rolling 12-month returns of the Ibbotson Associates SBBI US Inflation Index.

Of all the fears investors have faced over the past 30 years, high inflation wasn’t among them. In 2021, that’s changed.

Today, the biggest questions for investors revolve around inflation: How high will it go and how long will it last? Is it “transitory” as the Federal Reserve claims? Or is elevated inflation the new normal amid labor shortages, supply chain bottlenecks and a severe energy crunch?

The uncertain path of the pandemic makes near-term conditions difficult to predict but, over the long term, the picture comes into better focus, says Pramod Atluri, principal investment officer of The Bond Fund of America®.

“While we are facing a cyclical rise in inflation and interest rates today, when I look out five years, I think U.S. economic growth will be slower and inflation may be lower,” Atluri says. Economic growth should slow due to high debt levels and fading stimulus, resulting in a return to GDP gains of 1.5% to 2.5% a year. Consequently, interest rates should stay relatively low as well.

“In the meantime, we are laser focused on inflation because that’s the biggest risk to investors’ portfolios over the near term,” Atluri explains. “If we are wrong about inflation, we will be wrong on the upside, so it makes sense to protect against that outcome.”

Over the past 100 years, U.S. inflation has stayed below 5% the vast majority of the time. More recently, in the aftermath of the 2007–2009 global financial crisis, inflation has struggled to hit 2% on a sustained basis. And that’s despite unprecedented stimulus measures engineered by the Fed in an attempt to reach the central bank’s 2% goal.

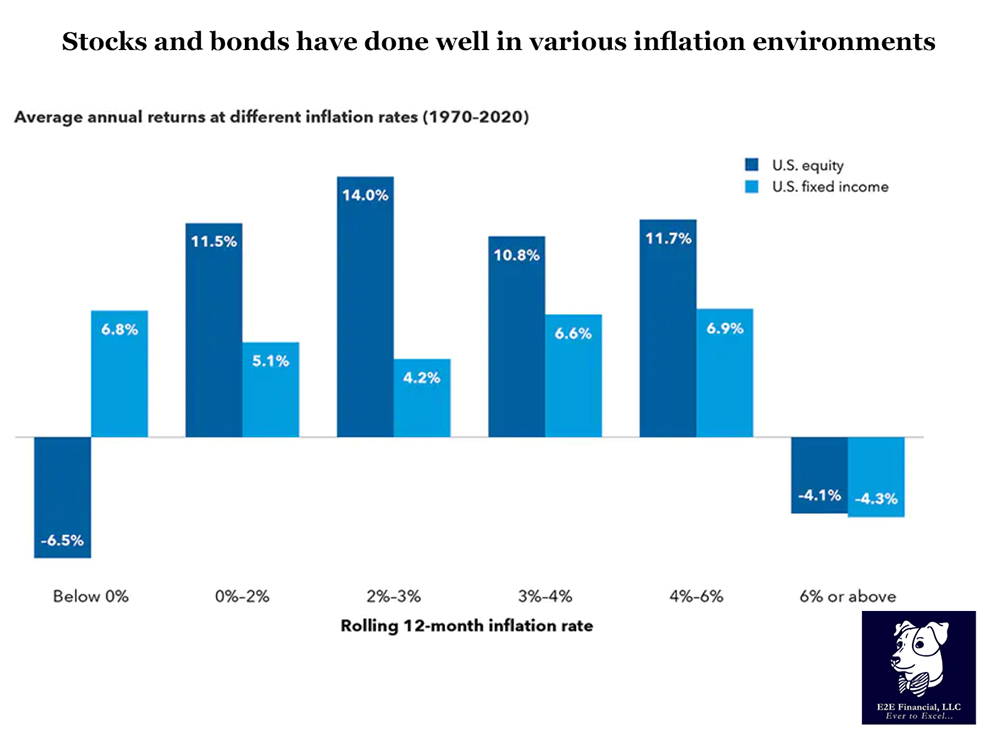

Another important point: It’s mostly at the extremes — when inflation is 6% or above — that financial assets tend to struggle. Stocks have also come under pressure when inflation goes negative, as one would expect.

For investors, some inflation can be a good thing. Even during times of higher inflation, stocks and bonds have generally provided solid returns as shown in the accompanying chart.

Need to review your portfolio to see how its poised for possible inflation? Reach out, we’d love to give you a second opinion on your long term investments.

This material was prepared by Capital Group.

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.