U.S. EQUITY MARKETS MIXED HEADING INTO THE LABOR DAY WEEKEND AS NONFARM PAYROLLS MISS BY A LOT BECAUSE OF THE DELTA VARIANT

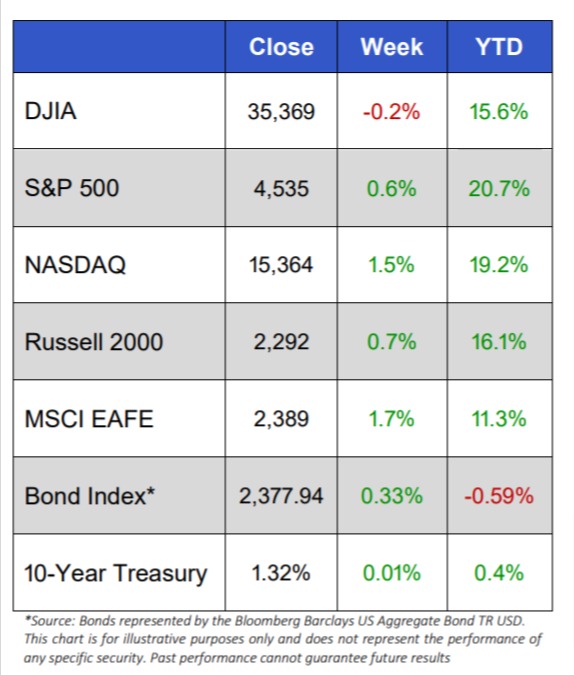

- U.S. equity markets wrapped up the week mixed, as the tech-laden NASDAQ (+1.6%) outpaced the large-cap S&P 500 (+0.6%) and smaller-cap Russell 2000 (+0.7%) heading into the holiday weekend

- The mega-cap DJIA struggled to find its footing all week and underperformed with a loss of 0.2% whereas the developed, international markets, as measured by the MSCI EAFE Index, leapt 1.7%

- The week started on a positive note and after Monday’s close, the U.S. markets seemed intent on maintaining their winning ways, but as the week wore on, economic data seemed to damper Wall Street’s mood

- There was a lot of manufacturing data that showed contraction activity in China while the U.S. remains in expansionary territory

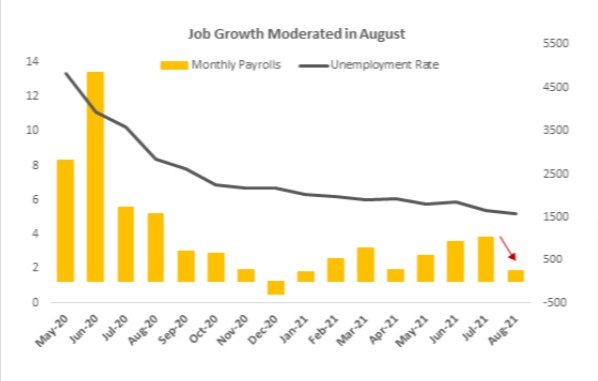

- At the end of the week, the Employment Situation report for August showed that nonfarm payrolls only increased by 235,000 while expectations were for a gain of about 3x that

- The Employment Situation report also noted a 0.6% increase in average hourly earnings, which was double consensus expectations of a 0.3% gain

- Of the 11 S&P 500 sectors, 7 were positive and 4 were negative and the range between the best and worst performer was significant

- Real Estate led the 7 positive sectors with a gain of 4.0% whereas Financials was the worst of the 4 negative performers with a loss of 2.5%

- The Volatility Index, as measured by the VIX, moved around a decent amount but ultimately ended the week almost exactly where it started

- WTI Crude breached the $70/barrel mark on Thursday before retreating to $69.18 at week’s end

Stocks Mixed on the Week

U.S. stocks were mixed this week, with the mega-cap DJIA losing 0.2% while NASDAQ jumped 1.5% and the Russell 2000 (+0.7%) and S&P 500 (0.6%) advanced too. And for those paying attention to the developed international markets, the MSCI EAFE Index advanced 1.7% and is in double-digits YTD.

The week just felt like a slow week on Wall Street and even the economic data wasn’t too exciting. Maybe it’s the end of the summer vacations that kept Wall Street trading volume down or Hurricane Ida that rained out a lot of plans or mixed economic data that just didn’t alarm traders one way or the other. Whatever the reasons, it just felt like Wall Street was trying to find its footing all week. And the markets are closed on Monday in observance of Labor Day

Despite Wall Street’s lethargy this week, the range of sector returns on the week was dramatic, as Real Estate leapt 4.0% whereas Financials declined 2.5%. The Energy sector retreated about 1.5% on the week, eating into last week’s 7% gains as WTI Crude crested $70/barrel on Thursday before retreating.

The economic data reported this week was generally positive as:

- Nonfarm payrolls added 235,000 jobs, much less than expected

- Average hourly earnings jumped 0.6%, double what was expected

- Consumer Sentiment took a big hit

- US new orders for manufactured goods in July rose 0.4%, which is the third consecutive monthly rise

- The service sector in the US continued growing in August but at a slower pace, as ISM’s services index dropped to 61.7 from a record high of 64.1 in July

- Auto sales in August dropped an unexpected 11.5% to an annual rate of 13.1 million (the fourth decline in a row)

Employment Situation Misses

The big miss on the week was on Friday when the Employment Situation report for August showed that nonfarm payrolls only increased by 235,000 while expectations were for a gain of about 3x that. From the U.S. Bureau of Labor Statistics release:

“Total nonfarm payroll employment rose by 235,000 in August, and the unemployment rate declined by 0.2 percentage point to 5.2 percent, the U.S. Bureau of Labor Statistics reported today. So far this year, monthly job growth has averaged 586,000. In August, notable job gains occurred in professional and business services, transportation and warehousing, private education, manufacturing, and other services. Employment in retail trade declined over the month.”

Further:

- The number of unemployed persons edged down to 8.4 million, following a large decrease in July.

- The number of long-term unemployed (those jobless for 27 weeks or more) decreased by 246,000 in August to 3.2 million but is 2.1 million higher than in February 2020.

- The labor force participation rate, at 61.7 percent in August, was unchanged over the month and has remained within a narrow range of 61.4 percent to 61.7 percent since June 2020.

COVID-Impact On Employment

“In August, 13.4 percent of employed persons teleworked because of the coronavirus pandemic, little changed from the prior month. These data refer to employed persons who teleworked or worked at home for pay at some point in the last 4 weeks specifically because of the pandemic.

In August, 5.6 million persons reported that they had been unable to work because their employer closed or lost business due to the pandemic–that is, they did not work at all or worked fewer hours at some point in the last 4 weeks due to the pandemic. This measure is up from 5.2 million in July. Among those who reported in August that they were unable to work because of pandemic-related closures or lost business, 13.9 percent received at least some pay from their employer for the hours not worked, up from 9.1 percent in the prior month.

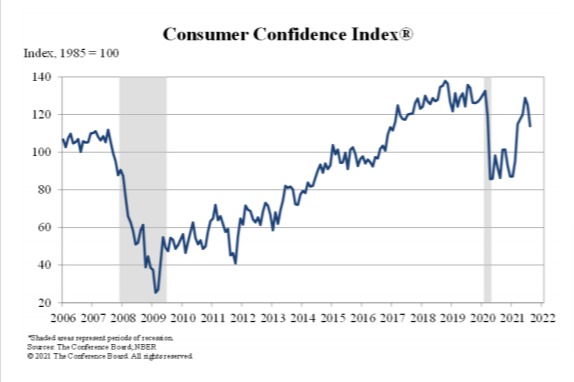

Consumer Confidence Sinks to Six-Month Low Due to Delta Variant

On the last day in August, the Conference Board reported that its Consumer Confidence declined in August, after falling in July. As of August 31st, the Index is at 113.8 (1985=100), which is down significantly from 125.1 in July.

Further, it was reported that:

- The Present Situation Index, which is based on consumers’ assessment of current business and labor market conditions, fell to 147.3 from 157.2 last month.

- The Expectations Index, which is based on consumers’ short-term outlook for income, business, and labor market conditions, fell to 91.4 from 103.8.

Said Lynn Franco, Senior Director of Economic Indicators at The Conference Board: “Concerns about the Delta variant – and, to a lesser degree, rising gas and food prices – resulted in a less favorable view of current economic conditions and short-term growth prospects. Spending intentions for homes, autos, and major appliances all cooled somewhat; however, the percentage of consumers intending to take a vacation in the next six months continued to climb.”

Present Situation

Consumers’ appraisal of current business conditions declined in August.

- 19.9% of consumers said business conditions are “good,” down from 24.6%.

- 24.0% of consumers said business conditions are “bad,” up from 20.0%.

Consumers’ assessment of the labor market eased.

- 54.6% of consumers said jobs are “plentiful,” down from 55.2%.

- 11.8% of consumers said jobs are “hard to get,” up from 11.1%.

Expectations Six Month Hence

Consumers’ optimism about the short-term business conditions outlook deteriorated in August.

- 22.9% of consumers expect business conditions will improve, down from 30.9%.

- 17.8% expect business conditions to worsen, up from 11.9%.

Consumers were somewhat less optimistic about the shortterm labor market outlook.

- 23.0% of consumers expect more jobs to be available in the months ahead, down from 25.5%.

- 18.6% anticipate fewer jobs, up from 17.8%.

Consumers were less upbeat about their shortterm financial prospects.

- 17.9% of consumers expect their incomes to increase, down from 20.0%.

- 10.1% expect their incomes will decrease, up from 8.8%.”