The U.S. economy has demonstrated surprising resilience in the six months since President Trump unveiled a long list of tariffs against virtually every trading partner. In the aftermath of “Liberation Day,” fears of an imminent recession have eased as investors have started to envision a future without a tariff-induced trade war.

“Tariff uncertainty hasn’t fully abated but the administration has moved away from brinkmanship in favor of negotiations,” says Cheryl Frank, portfolio manager.

Slowing job growth and consumer spending patterns suggest the economy is weakening. However, there are reasons for optimism, Frank notes. From the passage of the tax bill to declining interest rates, there is less uncertainty on many fronts compared to earlier this year. Below are five forces that could pave the way for continued economic expansion.

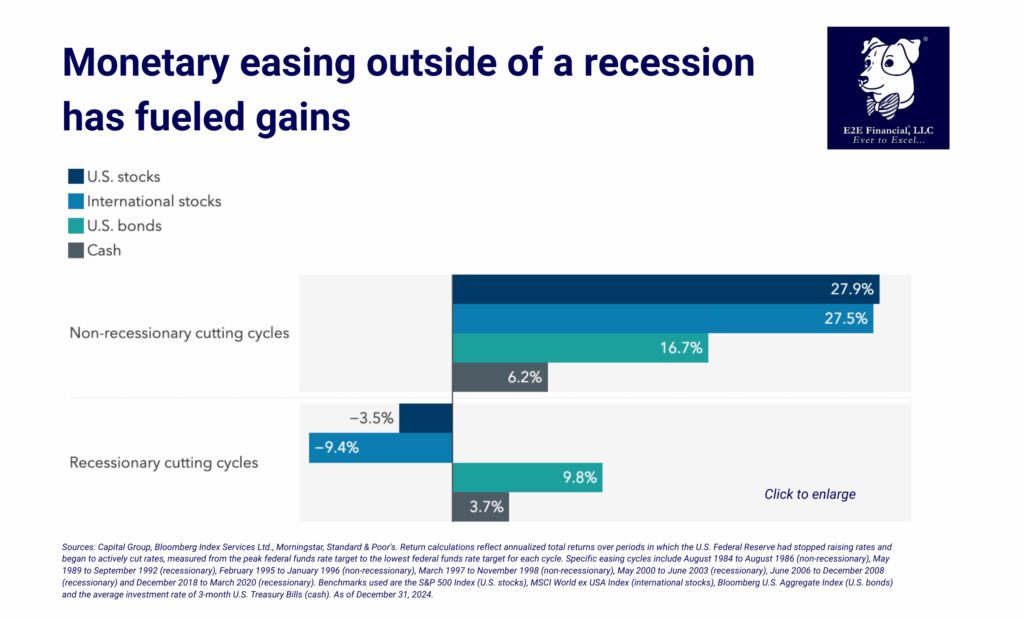

1. A dovish Fed starts rate-cutting cycle

The Federal Reserve’s latest rate cut arrived at a moment of economic softness — namely sluggish job growth. Officials guided additional cuts through 2028, signifying a dovish stance.

2. Tax bill functions as a “massive stimulus check”

Still, there are concerns borrowing costs may not decline to levels that rekindle spending. After all, the Fed cut interest rates in September 2024, only to see the benchmark 10-year U.S. Treasury, which underpins borrowing costs, rise instead. The culprit? A string of unexpectedly strong economic data prompted investors to recalibrate policy expectations, pushing rates higher.

3. Deregulation can spur growth outside of AI

A deregulatory environment could benefit some companies, including those left out of the artificial intelligence boom.

4. Rising defense budgets are a long-term tailwind

As NATO partners boost defense budgets, demand for products across a range of industries should jump, according to Frank.

5. AI investments continue to climb

Spurred by the arrival of ChatGPT, the AI economy has become a powerful engine of U.S. growth. As of June 30, 2025, technology spending — which includes research and development and data centers — accounted for roughly 7.5% of U.S. GDP, surpassing the dot-com era peak and poised to rise further.

Still, there are reasons for optimism as the U.S. economy and stock market have proven naysayers wrong time and again. Over the long run, investors who remained fully invested during periods of heightened uncertainty and market volatility have3 often emerged stronger. “I believe in staying invested,” Frank explains. “Even when markets get a little too excited or fearful, discipline and a focus on fundamentals help me navigate the volatility.”

Want a deeper look at how policy could affect the economy and markets? Explore Capital Group’s the full piece here. Curious what this means for your personal portfolio? Schedule your complimentary consultation with us to review!

We’re always here to help you navigate with clarity and confidence.

Plus, your weekly market update is here.