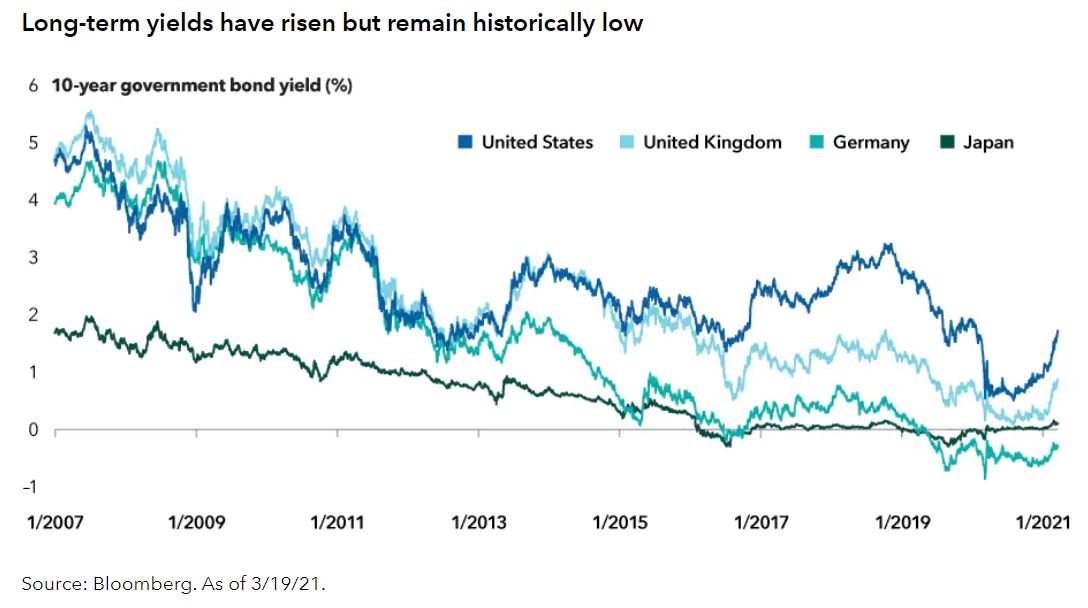

After a stellar 2020, the bond market is coming under pressure. Massive government stimulus measures and an improving economic outlook are combining to stoke one of fixed income investors’ biggest fears: higher inflation.

The selloff has been sharp. After rising more than 7% last year, the Bloomberg Barclays U.S. Aggregate Index is down more than 3% on a year-to-date basis. The key questions for investors: Is the selloff warranted, and are rates likely to continue rising significantly from here? Our answer to both is no.

1. The market is overreacting

We believe the market is getting carried away with rate hike anxiety. Market expectations for a Federal Reserve rate hike in 2022 are earlier than we anticipate.

2. Rates are rising for a good reason — a strong recovery

Growth and inflation expectations have picked up, as markets are seeing light at the end of the pandemic tunnel. Vaccines are steadily rolling out, and infections are on the decline: These are harbingers of stronger growth. They also underscore that the improving U.S. labor market trend will likely continue as COVID-19 restrictions lift.

3. Core taxable bonds have shown resilience amid rate hikes

Bond values decline when rates rise. But history suggests that this isn’t the whole story. When rates rise, they historically haven’t done so quickly and sharply enough to cause significant losses over a hiking cycle for core bond investors.

4. Core municipal bonds have also shown stability amid rising rates

Like taxable bonds, municipal bonds have also felt the impact of rising yields this year. While munis have become more credit driven in recent years, rates still have a major impact. Returns for the Bloomberg Barclays Municipal Bond Index are down 0.75%, year-to-date through March 18. But as with taxable bonds, a longer term perspective can be revealing. Consider those same periods of Fed rate hikes as shown earlier for the core taxable index.

Want to learn more? See the full article here. (source: Capital Ideas)