Investors are accustomed to volatility in stocks, but 2022 brought unprecedented challenges to the bond market as well. The U.S. Federal Reserve raised rates aggressively to fight inflation, battering both equity and fixed income investments. By year-end, those efforts helped to bring inflation from a peak of 9.1% in mid-2022 to 6.0% in February 2023, as measured by the Consumer Price Index (CPI).

Higher income can serve as a shock absorber

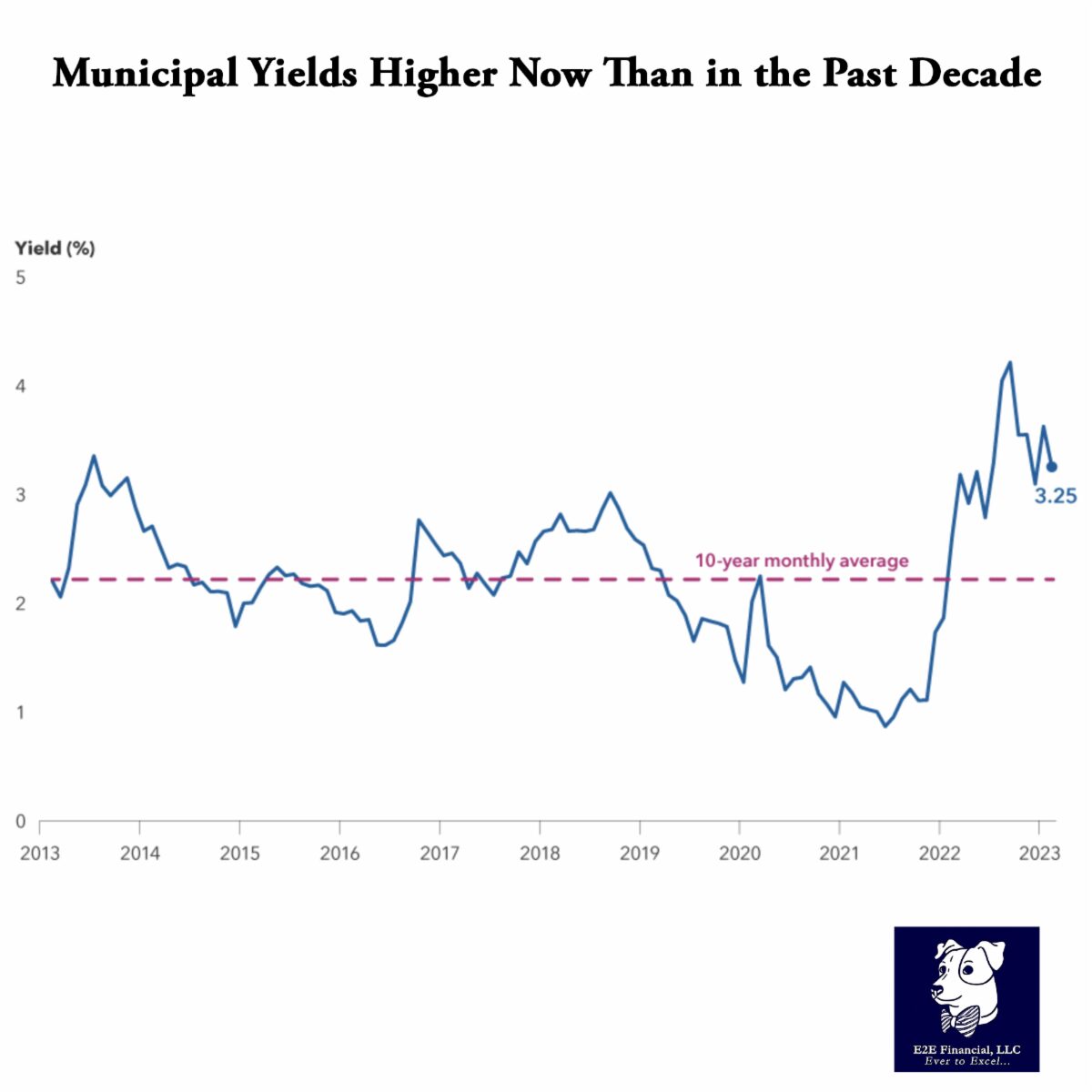

Should volatility move center stage once again, Municipal Bonds (munis) have another advantage: Bond yields are near or above decade highs. The Bloomberg Municipal Bond Index began 2023 2.5 percentage points higher than the start of 2022. The lack of income provided by munis at the start of last year is part of the reason returns were so dire once rates began sharply rising. The bonds had very little income return to cushion the negative price return impacts from rising rates.

A painful road? Yes, but today’s rates can furnish greater shock absorption. If unexpected shocks hit markets and impact munis, the likelihood of negative returns is more distant with a stronger income component to soften the blow. The yield to worst of the Bloomberg Municipal Bond Index (representing the broad muni market) was 3.25% at the end of March. For periods when the yield was in this range (+/– 0.3%), the five-year forward return was 4.3% (according to an analysis of Bloomberg data over the past 20 years). When investing at yields observed in recent months, munis have traditionally experienced solid returns.

Contracting markets result in anxious investors, even if it’s part of the normal market cycle. You can’t have an expansion without the rubber band eventually snapping back. In recessionary periods, many high-quality bond sectors may fare well relative to equities. However, munis offer some unique advantages, including strong fundamentals, distinctive characteristics that provide some resistance to recessionary impact and higher current yields to act as a buffer. For investors seeking tax-exempt income, munis warrant consideration, particularly if growth continues to slow and recession fears grow.

Want to learn more? Reach out and schedule your free consultation.