If you are tempted by the higher interest rates on bank products, read this from our partners at JP Morgan…..

“Investors tempted by higher cash rates should remember that re-investment risk is elevated, and holding too much cash can come at a cost.

Over the past two years, the Federal Reserve’s aggressive monetary tightening lifted short-term interest rates to their highest levels since the early 2000s. As a result, investors pounced on cash-like products for both safety and income in 2023, pushing money market fund assets to a record-high $5.98 trillion, and this number is still climbing. Of course, cash serves an important role in portfolios and yields above 5% look attractive. However, investors tempted by higher cash rates should remember that re-investment risk is elevated, and holding too much cash can come at a cost.

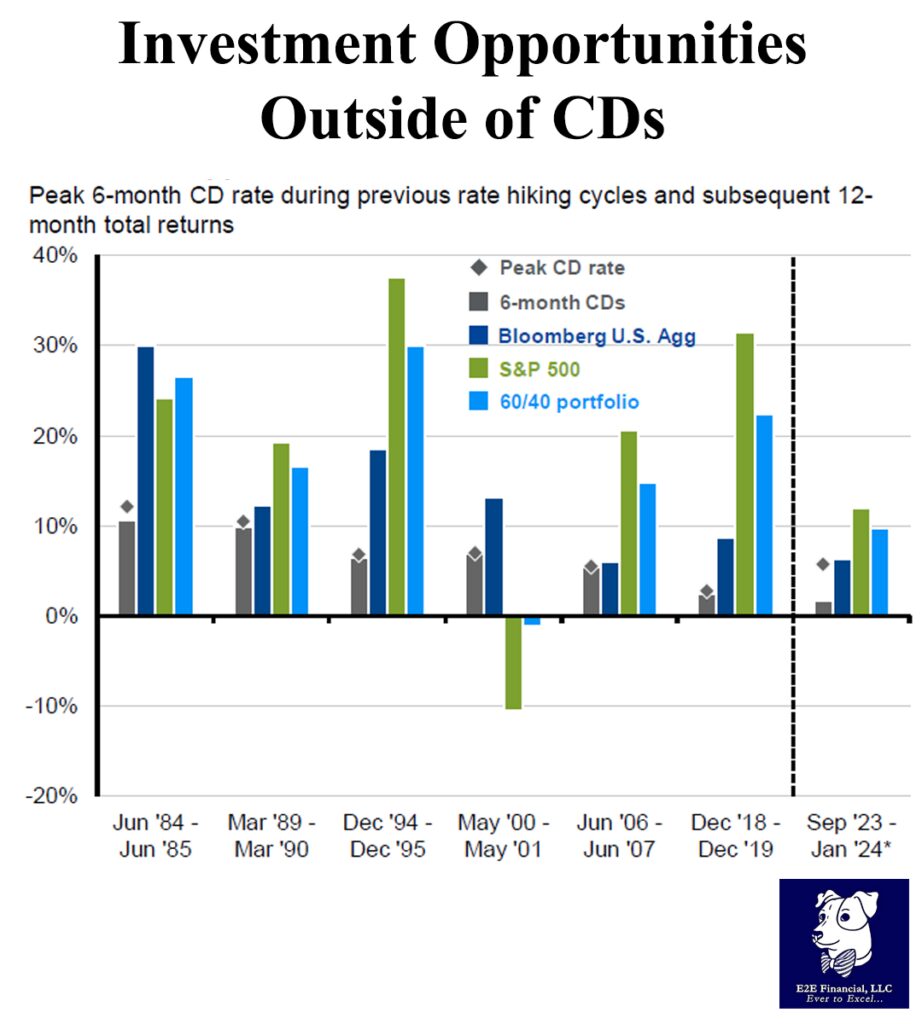

Looking across the last six rate hiking cycles reveals that cash tends to underperform both stocks and bonds in the year after rates peak. In fact, the S&P 500 and a balanced 60/40 stock-bond portfolio outperformed 6-month CDs in five of the last six such periods, while the Bloomberg U.S. Aggregate outperformed across all six periods. Moreover, assuming that peak rates for the current cycle are already behind us, cash is on pace to underperform once again. Since month-end CD rates peaked in September, the S&P 500 and U.S. Agg have experienced impressive gains of 12.1% and 6.5%, respectively, while a 6-month CD has returned a more modest 1.7% over the same period.

Despite the recent market rally, investors have not missed their chance to move long-term money out of money market funds, and the opportunity cost of holding too much cash could increase further as the Fed eases policy in 2024. Given this, long-term investors should embrace opportunities across equities, fixed income and private markets to achieve their long-term goals.”

Need help on deciding how much you should have in cash and how much to allocate to long term investing? We can help! Reach out and let us help you.

Your weekly market update is here.